Changes in OLED panel market for smartphones

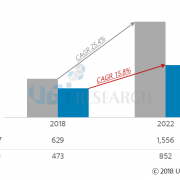

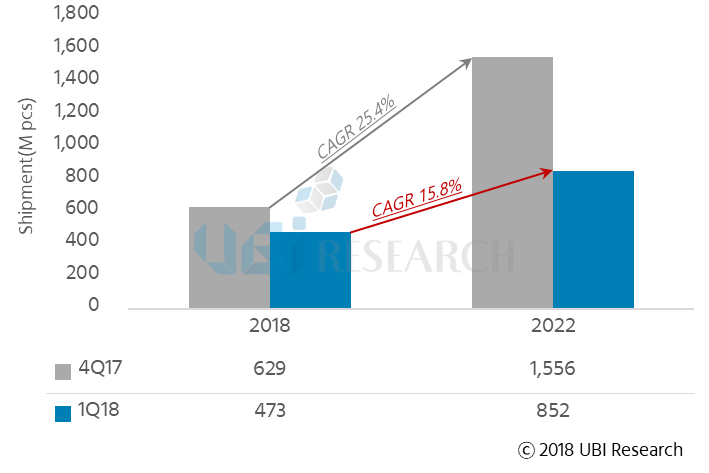

According to the ‘2018 1Q AMOLED Display Market Track’ published by UBI Research, OLED panel shipments for smartphones are projected to grow at an annual average growth rate of 15.8%, from 450 million units in 2018 to 850 million units by 2022. This is a 9.6% decline from the CAGR 25.4% expected in the fourth quarter of 2017.

<Shipment forecast of OLED panel for smartphones >

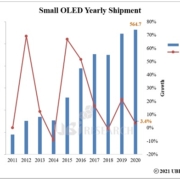

The reason shipment forecast of OLED panels for smartphones is declined compared with 4Q,2017 is because smartphone trends have been reflected recently. The smartphone market is sluggish due to the prolonged replacement period of smartphones and the lack of new technology. In addition, the average size of smartphones has enlarged faster than expected, and the size of smartphones is expected to increase gradually with the anticipation for the launch of foldable OLEDs, leading to a slowdown in the shipment growth.

For flexible OLED, ASPs have risen due to the lack of supply, caused by mainly dependent on Samsung Display, and Chinese set makers are burdened by its high prices. As low-priced full-screen LCDs are emerging, it is forecasted that demand for rigid OLEDs will decline since Chinese set makers are adopting more LCDs than OLEDs in rigid smartphones.

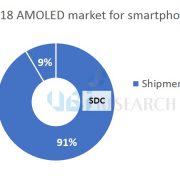

Panel makers in Korea and China have aggressively invested in the Gen6 OLED line in 2016 and 2017. Starting this year, however, they are reviewing the investment and operation time frame of mass production lines, with looking into the smartphone demand. As OLED panels for smartphones account for more than 90% of the total OLED panel market, it is an important factor for the investment flow of panel makers.

Meanwhile, ‘2018 1Q AMOLED Display Market Track’ is based on the market performance data and projected system that UBI Research has accumulated over 15 years. It consists of 8 (eight) modules in total: Panel cost analysis, Market forecast, Supply and demand analysis, Market performance (sales), Competitiveness analysis of panel makers, ASP, Supply chain analysis and investment & Mass production line status.