Chinese Companies Begin Active OLED Panel Production Line Operation

The Chinese companies are estimated to begin active production of OLED panels, a market for which used to be dominated by Korean companies. Following this, the market for emitting materials for OLED panels also started shifting.

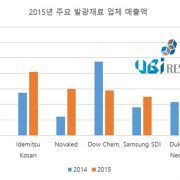

“OLED Emitting Material Annual Report”, published by UBI Research in March 2015, forecast that Chinese companies will begin mass production of AMOLED panel for mobile in second half of 2015, and large area panel from 2017. Together with China’s mass production of panel, emitting material market is estimated to grow into US$ 560 million in 2015, a 16% increase from 2014, and approximately US$ 2,500 million in 2020.

Emitting material companies that rely heavily on Samsung and LG’s panel mass production are anticipating supply chain advancement to China, and considering business expansion in China in order to increase revenue. Idemitsu Kosan is the most proactive and has already started supplying materials to BOE and Tianma. Duksan Neolux began supplying to BOE’s Ordos factory and deliberating on furthering business in China. (Source: Trend Analysis of Key Material Companies, 2015 OLED Emitting Material Annual Report)

With the expansion of panel market, increased competitiveness by Korean emitting material companies is required to acquire supply chain. This is also when Korean panel production companies need to obtain technology in order to retain their market share against Chinese companies.

<Emitting Material Market Share by country: UBI Research>