[UBI Research China Trend Report] Will BOE Provide UPC Panel with Transparent PI Substrate to Oppo?

BOE, the largest display maker in China, produces UPC (Under Panel Camera) panels with transparent PI substrates.

UPC is a technology that makes a full screen of a smartphone possible by placing the front camera under the screen.

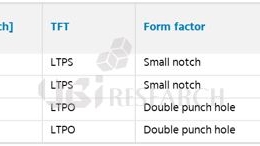

Introducing iPhone 14 Display Specifications and Panel Vendors

Samsung Display, LG Display, and BOE are expected to supply panels to Apple's new iPhone 14 series in 2022. It is expected that Samsung Display will supply panels to all models in addition to iPhone 13 series. LG Display will supply 6.12-inch LTPS models and 6.69-inch LTPO models. BOE will supply panels only to 6.12-inch LTPS models.

[2022 OLED KOREA CONFERENCE] LG Display's OLED 3.0 Captures Brightness and Lifespan Simultaneously

At the keynote session of UBI Research's '2022 OLED Korea Conference' held from April 6th to 8th, Sang-Hyun Ahn, Managing Director of LG Display, announced, 'The Present and Future of Automotive OLED Display: LG Display's Future Outlook'.

[2022 OLED KOREA CONFERENCE] LG Display Executive Vice President Hyun-Woo Lee, Advancements in the Display Market with Technological Innovation that Suits Changing Lifestyles

Executive Vice President Lee explained OLED technology innovation, future application fields, and market changes. He mentioned that COVID-19 has increased everyone’s time at home and changes in life display is necessary to match it.

[2022 OLED KOREA CONFERENCE] Samsung Electronics Joins the OLED TV Market, and the TV Panel Market is Expected to Exceed 20 million Units in 2025

At UBI Research’s ‘2022 OLED Korea Conference’ held on April 6th-8th, UBI Research CEO Choong-Hoon Lee gave a presentation on, ‘OLED Market Review’. CEO Lee presented the status of the entire OLED industry, market, and outlook with a focus on issues in 2022.

[2022 OLED KOREA CONFERENCE] What New Technology Will Advance OLED for Mobile Devices?

At UBI Research’s ‘2022 OLED Korea Conference Tutorial’ held on April 6th-8th, Dr. Jae-Jin Yoo from the Department of Electrical and Computer Engineering at Seoul National University gave a presentation on, ‘An Overview of OLED Materials and Devices’.

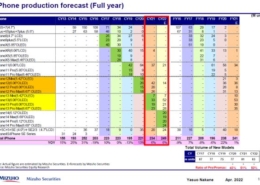

[2022 OLED KOREA CONFERENCE] Expected iPhone Shipments to Remain Strong at 249 Million Units in 2022

At UBI Research's '2022 OLED Korea Conference' held from April 6th to 8th, Yasuo Nakane, senior analyst at Mizuho Securities, presented 'Consumer Electronics/Flat Panel Display Industry What is the Outlook for Turbulent 2022?' .

http://enolednet.openhaja.com/wp-content/uploads/2022/04/OLEDKOREAConference_day_2..jpg

216

385

olednet

/wp-content/uploads/2015/09/logo_oled.png

olednet2022-04-20 09:50:372022-04-25 09:49:242022 OLED KOREA Conference Day2 (Session highlights)

http://enolednet.openhaja.com/wp-content/uploads/2022/04/OLEDKOREAConference_day_2..jpg

216

385

olednet

/wp-content/uploads/2015/09/logo_oled.png

olednet2022-04-20 09:50:372022-04-25 09:49:242022 OLED KOREA Conference Day2 (Session highlights) http://enolednet.openhaja.com/wp-content/uploads/2022/04/2022-OLED-KOREA-Conference-002-1.png

1080

1920

olednet

/wp-content/uploads/2015/09/logo_oled.png

olednet2022-04-20 09:45:182022-04-25 09:47:172022 OLED KOREA Conference Day1 (Session highlights)

http://enolednet.openhaja.com/wp-content/uploads/2022/04/2022-OLED-KOREA-Conference-002-1.png

1080

1920

olednet

/wp-content/uploads/2015/09/logo_oled.png

olednet2022-04-20 09:45:182022-04-25 09:47:172022 OLED KOREA Conference Day1 (Session highlights)

[China Trend Report] TCL CSOT's T8 Project to Invest in Generation 8.5 Inkjet Printing Technology

According to the ‘China Trend Report’ published by UBI Research, TCL CSOT plans to apply the generation 8.5 inkjet printing OLED technology to the T8 line. It is expected that some layers will be formed by vapor deposition in the inkjet printing method rather than the complete inkjet printing method. The location is likely to be Guangzhou.

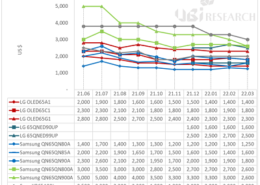

Analysis of 65-inch Premium TV Price Trends in the First Quarter of 2022

We analyzed the prices of 65-inch TVs of Samsung Electronics' QLED TVs, OLED TVs from LG Electronics and Sony, and LG Electronics' QNED TVs until March 2022.

The models we investigated at Samsung Electronics were 4K high-end model QN90A, 4K entry-level models QN85A and QN80A, and 8K models QN800A and QN900A. The models at LG Electronics were OLED TVs A1, C1, and G1 models and QNED TVs QN90UP and QN99UP. The models at Sony Electronics were OLED TV XR65A80J and XR65A90J.

Samsung Display Expands its Business from Smartphones to OLED for IT

According to UBI Research’s published quarterly report, “1Q22 Medium & Large OLED Display Market Track”, mid-to-large OLED sales in the fourth quarter of 2021 was up 29.1% (QoQ) from the previous quarter at $2.2 billion and up by 76.9% (YoY) from the same period of the previous year.

Although Samsung Display leads the way in the OLED market for mobile devices, LG Display overwhelming dominates the mid to large-sized OLED market.

[China Trend Report] Honor Magic4 Series, Panel Supply from BOE and Visionox

According to the ‘China Trend Report’ published by UBI Research, Honor,

a Chinese smartphone manufacturer, announced Magic4 and Magic4 Pro at MWC 2022 held on February 28th. Both products are 6.81 inches in size. Magic4 has a resolution of 1224x2664 and Magic4 Pro has a resolution of 1312x2848. The peak brightness of both products is 1,000nits and the refresh rate is 120Hz. LTPO TFT and 1,920Hz high frequency PWM dimming technology are applied.

a Chinese smartphone manufacturer, announced Magic4 and Magic4 Pro at MWC 2022 held on February 28th. Both products are 6.81 inches in size. Magic4 has a resolution of 1224x2664 and Magic4 Pro has a resolution of 1312x2848. The peak brightness of both products is 1,000nits and the refresh rate is 120Hz. LTPO TFT and 1,920Hz high frequency PWM dimming technology are applied.

Simbeyond enters new phase of growth with investor and partner ECFG

Eindhoven, 25 February 2022. ECFG has acquired a minority share in Simbeyond through Eindhoven Venture Capital Fund II (EVCF II). Simbeyond has developed simulation software (Bumblebee) that can very accurately measure the effects of OLED materials at the device level. This is the first financing round for Simbeyond. The financing will be used to accelerate company growth (R&D and sales organization).

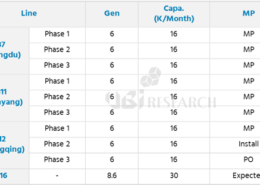

[China Trend Report] Significant Reduction of BOE’s Panel Supply to Apple in February and March due to Touch IC Supply Issue

According to the 'China Trend Report' published by UBI Research, BOE B11 (Mianyang) plant is experiencing difficulties in supplying quantities to Apple due to the supply and demand problem of Touch IC.

The report analyzed that BOE's shipments to Apple have decreased significantly due to the supply and demand problem of Touch IC.

As a result, shipments are expected to fall far short of the 2022 target set by BOE.

The report analyzed that BOE's shipments to Apple have decreased significantly due to the supply and demand problem of Touch IC.

As a result, shipments are expected to fall far short of the 2022 target set by BOE.

Foldable Phones Predicted to Exceed 100 Million Units by 2026

According to UBI Research’s “1Q22 Small OLED Display Market Track” Small OLED Display (10-inches or smaller watch, smartphone, foldable phone, etc.) shipment in 2021 was 746 million, a 34.4% increase from the previous year's 555 million.

The reason for the increase in shipments compared to 2020 can be attributed to the increased sales of iPhone 12, iPhone13, and the unexpectedly strong sales of Galaxy Z’s Fold 3 and Flip 3.

The reason for the increase in shipments compared to 2020 can be attributed to the increased sales of iPhone 12, iPhone13, and the unexpectedly strong sales of Galaxy Z’s Fold 3 and Flip 3.

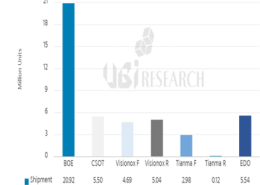

[UBI Research China Trend Report] Chinese Panel Makers’ Total Shipments of OLED Panels for Smartphones in the Fourth Quarter of 2021 Increased by 26% Compared to the Third Quarter

According to UBI Research’s 'February 1st China Trend Report’, total shipments of OLED panels for smartphones by Chinese panel makers in the fourth quarter of 2021 were 44.8 million units, a 26% increase from 35.57 million units in the previous quarter.

By company, BOE shipped 20.9 million units and occupied a 46.7% share, followed by Visionox with 9.7 million units, EverDisplay Optronics with 5.5 million units, CSOT with 5.5 million units, and Tianma with 3.1 million units.

By company, BOE shipped 20.9 million units and occupied a 46.7% share, followed by Visionox with 9.7 million units, EverDisplay Optronics with 5.5 million units, CSOT with 5.5 million units, and Tianma with 3.1 million units.

China Aims for the Foldable Phone Market with Multiple Foldable Phone Launches

Samsung Electronics widely successful release of its foldable phones, Galaxy Z Fold 3 and Flip 3 last year has risen expectations for establishing foldable phones into the mainstream.

Chinese companies such as Huawei, Xiaomi, Oppo are also releasing multiple foldable phones.

As the first foldable phone in China, Huawei has been releasing the Mate X series every year since its launch in 2019.

The Mate X and the Mate Xs released in 2020 are 8 inches in size and folds outward.

The external display is 6.6 inches with a resolution of 1148x2480 and an aspect ratio of 19.5:9.

Chinese companies such as Huawei, Xiaomi, Oppo are also releasing multiple foldable phones.

As the first foldable phone in China, Huawei has been releasing the Mate X series every year since its launch in 2019.

The Mate X and the Mate Xs released in 2020 are 8 inches in size and folds outward.

The external display is 6.6 inches with a resolution of 1148x2480 and an aspect ratio of 19.5:9.

SDC, 4Q2021 The Highest Smartphone Shipments 125 million units, Highest market share of flexible OLED 50.1%

According to UBI Research Weekly Report, Samsung Display’s OLED shipped 480 million units in 2021. The highest number of shipments were in the 4th quarter at 133 million units and the second highest was in the in 3rd quarter at 129 million units.

Samsung Display OLED application products shipped in 2021 were smartphones, watches, tablet PCs notebooks and TVs. OLED for TVs started shipment in the fourth quarter of last year. It was the first OLED for TV shipment in eight years since 2013 when they had discontinued mass production.

LG Display Achieves Record Sales in 2021, Swinging a Profit after Three Years

As LG Display posted the highest sales ever, at the same time it also made a sharp pivot into a profit for the first time in three years.

On the 26th, LG Display announced that it had achieved annual sales of 29.878 trillion won and operating profit of 2.23 trillion won in 2021.

“This is the result of the large-sized OLED panels in the premium market, the strengthening of the small and medium-sized OLED business base, and the innovation of LCD structures centered on IT products,”

On the 26th, LG Display announced that it had achieved annual sales of 29.878 trillion won and operating profit of 2.23 trillion won in 2021.

“This is the result of the large-sized OLED panels in the premium market, the strengthening of the small and medium-sized OLED business base, and the innovation of LCD structures centered on IT products,”

Analysis of 65-inch Premium TV Price Trend in 2021

This is an analysis for the 65-inch TV prices for Samsung Electronics' QNED TV, LG Electronics' OLED TV, and Sony's OLED TV in 2021.

Samsung Electronics started with the 4K high-end models QN90A and the 8K models QN800A and QN900A.

The entry-level models QN80A and QN85A were released sequentially.

The 4K models QN90A, QN85A, and QN80A were priced at $2,600, $2,200, and $1,700 respectively. The 8K models QN900A and QN800A were priced at $5,000 and $3,500.

Samsung Electronics started with the 4K high-end models QN90A and the 8K models QN800A and QN900A.

The entry-level models QN80A and QN85A were released sequentially.

The 4K models QN90A, QN85A, and QN80A were priced at $2,600, $2,200, and $1,700 respectively. The 8K models QN900A and QN800A were priced at $5,000 and $3,500.