Korea’s Survival Hangs on OLED; Government Support is Urgently Needed

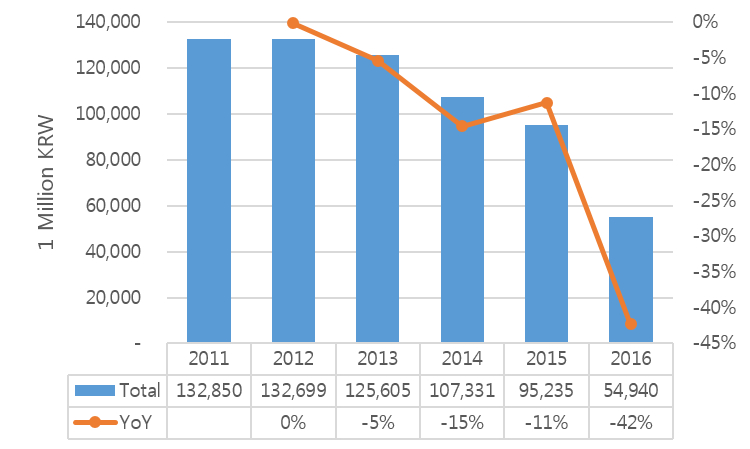

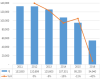

The last 5 years of budget for Korean semiconductor, which is a key industry for the nation, and display related industry’s original technology development expenses was researched and analyzed.

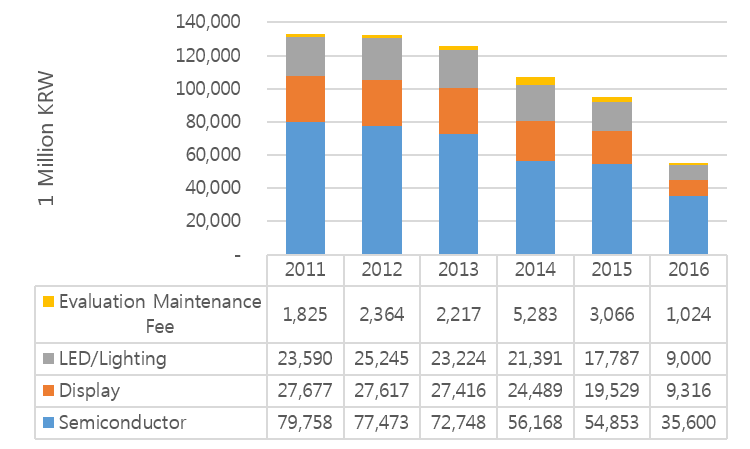

Electronic information device sector’s expenses can be categorized into semiconductor, display, LED/lighting, and evaluation maintenance fee.

In 2011, 130,000 million KRW was provided as technology development expense, but since then the amount annually decreased. In 2015, the amount was 95,000 million KRW, but in 2016, it is estimated to decrease further 42% and only 55,000 million KRW is expected to be provided.

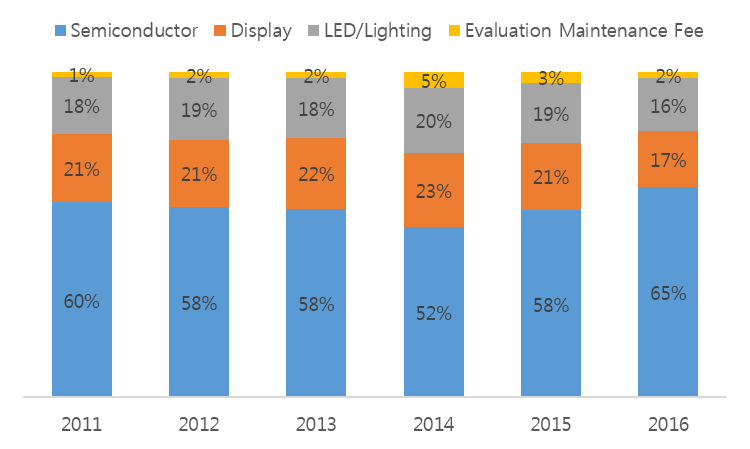

Semiconductor funding for 2015 occupies 58% of the total budget with 54,800 million KRW. Although that amount will be reduced to 35,600 million KRW in 2016, it is expected to occupy 65% of the total funding.

For display section, the 2015 funding is only 19,500 million KRW, a 21% of the total budge. In 2016, this is estimated to fall to 17%.

The government funding for display sector, which is the core of Korean electronic information industry, is around the same level as LED/Lighting sector.

The rapid reduction of government funding for display industry is expected to cause much difficulty in future display business.

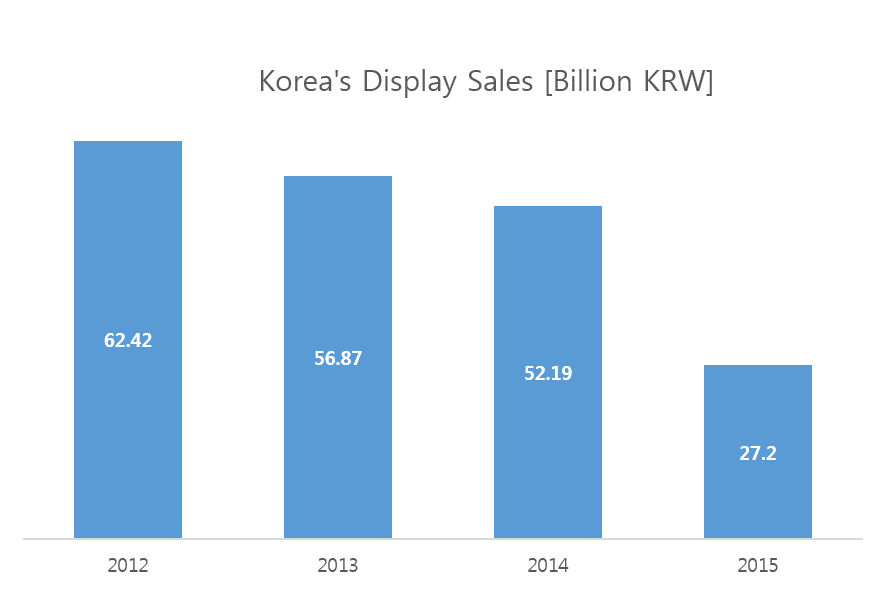

The Korean display panel market that is being maintained by 2 companies, Samsung Display and LG Display, recorded 62 billion KRW in 2012. However, it fell to 52 billion KRW in 2014, and the market power is gradually weakening. As Chinese companies are becoming more active in LCD market, Korean companies’ price competitiveness is waning in low-priced panel market.

If BOE’s Gen10.5 line begins operation in 2018, Korean display companies’ market power is analyzed to rapidly fall in LCD market. In order for the Korean display business to take-off again, now is the time for the government to fund OLED panel which has high added value.