“Can’t Cope Because of LCD”… Samsung·LG, in Despair over Large Deficit

Hyunjoo Kang / OLEDNET / jjoo@olednet.com

<CES 2016 Exhibition. Many Chinese Companies’ LCD TV Were Present.>

Due to the oversupply of LCD panel in global display market, the opinion that Samsung Display and LG Display will also not be able to avoid large amount of deficit is becoming stronger.

As of March 28, according to market experts including securities industry, Samsung Display and LG display will both face sizable deficit in LCD sector this quarter.

For Samsung Display, Q1 LCD sector is expected to record up to 900,000 million KRW. The company is estimated to reduce the overall display industry deficit with the OLED profit of approximately 400,000 million – 500,000 million KRW. Consequently, Samsung Display is to record approximately 400,000 million – 500,000 million KRW of deficit in Q1 2016.

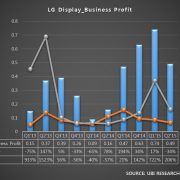

LG Display, whose over 90% of the current production line is for LCD, is estimated to be hit more directly. LG Display has been showing profit in LCD until 2015, but is expected to turn to deficit in Q1 2016. LG Display has been showing deficit in OLED, and market experts are also expecting more deficit in Q1 2016.

◆ Unlike Samsung and LG’s High Quality, China Floods Cheaper LCD

The main reasons that display industry is having difficulty include oversupply of Chinese LCD, and overall market depression. Chinese companies’ affordable LCD supply, backed by active support of Chinese government, is damaging Korean companies.

Particularly, companies such as BOE, which greatly improved productivity with much assistance from Chinese government including corporate tax exemption, have been pressuring Samsung, LG, and others in the global LCD market. As the Chinese companies are still aggressively investing in LCD facilities, the LCD oversupply is analyzed to continue until 2018.

Accordingly, the majority of the industry believe that both Samsung Display and LG Display will carry out LCD production line restructuring. In a recent conference hosted by information company IHS, senior analyst Jeong Du Kang revealed that LG Display could restructure Gumi’s P2, 3, 4 production lines, and added that some thinks L6 production could stop following the same of L5 production line last year.

As expected, both companies do not officially comment on these forecast. However, most of the industry players believe that the production line changes of the 2 companies are inevitable.

One display expert explained that “unlike Samsung and LG which do not accept even small faults, Chinese companies are pouring out products with slightly lesser quality armed with lower price, and will dominate the mainstream market”.

He also estimated that as Samsung and LG are nearing the situation where they have to give up LCD, the speed of which OLED will settle as the main player within the global display market will increase.