OLED performance analysis in the first half of 2020

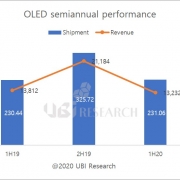

It was found that COVID-19, which has spread around the world since January this year, has adversely affected the OLED industry as well. According to UBI Research (CEO Choong Hoon Yi)’s [2020 OLED Display Semi-Annual Report], OLED total shipments and sales in the first half of 2020 were 231 million units and 13.2 billion dollars, respectively. Compared to shipments of 230 million units and sales of 13.8 billion dollars in the first half of last year, shipments increased by 1 million units but sales decreased by 600 million dollars.

The reason for the decrease in sales compared to the increase in shipments is because the shipments of OLEDs for watches, which are cheaper, have increased, but OLEDs for smartphones and TVs have decreased. OLED for watch was 22 million units in 1H19, but 1H20 increased significantly to 33.5 million units, helping to increase OLED shipments. However, the OLED market for smartphones decreased by 10.6 million units. The foldable OLED market has risen significantly with the Galaxy Z Flip, which Samsung Electronics released in the first half of this year.

The reason for the decrease in sales compared to the increase in shipments is because the shipments of OLEDs for watches, which are cheaper, have increased, but OLEDs for smartphones and TVs have decreased. OLED for watch was 22 million units in 1H19, but 1H20 increased significantly to 33.5 million units, helping to increase OLED shipments. However, the OLED market for smartphones decreased by 10.6 million units. The foldable OLED market has risen significantly with the Galaxy Z Flip, which Samsung Electronics released in the first half of this year.

In the future, the increase in line capacity for mobile devices by panel makers is expected to slow from 2023. Until 2022, investments by Chinese companies are maintained, but further investment is difficult to expect as the oversupply of OLED for smartphones continues.

Samsung Display is converting the LTPS TFT line of the A3 plant to the LTPO TFT line, and since it has been converted so that Y-OCTA can be manufactured at all plants, the mass production capacity is expected to decrease gradually, reaching 9 million square meters in 2021.

As a result, Korea’s mass-produced substrate area is 56.5% until this year, but from 2021, China is expected to have 1% mass-produced capacity, and after 2022, China’s mass-produced capacity will exceed 50%.