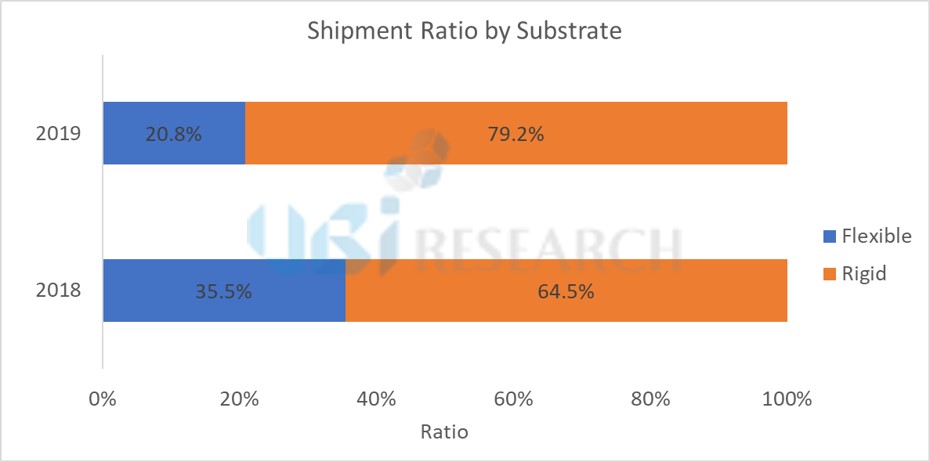

Rigid OLEDs dominate shipments of the OLED market for smartphones

Reporter : Daejeong Yoon

According to UBI Research’s 4th quarter OLED display market track, rigid OLED is still the main product in the OLED market for smartphones, with 79.2% of the total OLED market in 2019. As a result of counting and analyzing shipments up to the third quarter of 2019, rigid OLED accounted for 237 million units of the total shipment of 338 million units.

<Source: UBI Research Q4 OLED Market Track>

Display companies all over the world have invested heavily in the flexible OLED line, but rigid OLED is still the main OLED used in smartphones. This reflects that the display companies have invested without forecasting the market situation properly.

Rigid OLEDs for smartphones are mostly supplied by Samsung Display. Rigid OLEDs are also produced in China’s Visionox and EDO, but are not yet available to brand companies. As the A1 and A2 lines, which produce rigid OLEDs at Samsung Display, are both in full operation, Samsung Display can no longer supply products in the growing rigid OLED market.

Flexible OLED lines will continue to be invested by 2023, and the annual production area will increase to 20 million square meters per year, but the line capa for rigid OLEDs has been frozen since 7 million square meters per year.

<Source: UBI Research Q4 OLED Market Track>

Therefore, in order to cope with the growing rigid OLED market, it is necessary to convert flexible lines to rigid OLED lines or to further invest in rigid OLED lines.

In order for Samsung Display to dominate and have a differentiated market in the display industry, it is time for latecomers to consider converting flexible OLED lines to rigid OLED lines.