LG Display’s automotive OLED panel recognized for ‘best picture quality’ for passengers

LG Display’s automotive OLED panel recognized for ‘best picture quality’ for passengers

- Obtained international certification for ‘High Visibility Vehicle OLED’ from German TUV, a global certification body

- Provides a wide viewing angle while consistently maintaining high image quality in a wide range of driving environments and low temperatures of -40 degrees Celsius

Applying new OLED technology that stacks light emitting devices in multiple layers, improving screen brightness and lifespan

LG Display (CEO and President Ho-Young Jung)’s automotive OLED panel was recognized for its best picture quality in the global market.

LG Display announced on the 26th that it had obtained the ‘High Visibility Automotive OLED (OLED)’ certification from Germany’s ‘TUV Rheinland’, a global certification body.

LG Display’s automotive OLED panel consistently realizes the best picture quality in a wide range of driving environments, including the brightness (10 to 5,000 lux) that the driver encounters during the day and at night, and maintains the same picture quality even at a harsh low temperature of minus 40 degrees Celsius. In addition, it was evaluated that it accurately expresses even small contents that are only 5% of the full screen size without distortion at any viewing angle between the driver’s seat and the front passenger’s seat.

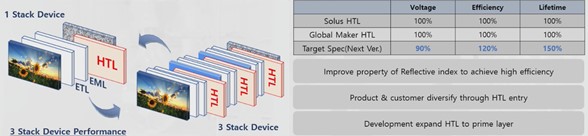

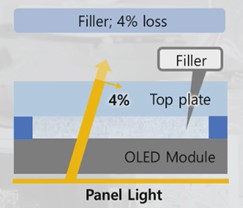

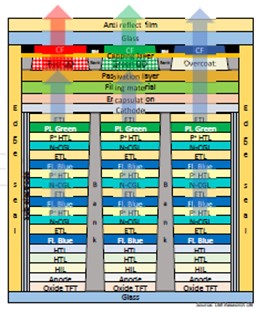

This product applies a new OLED technology(tandem) that stacks R(red), G(green), and B(blue) light emitting devices in multiple layers to significantly improve screen brightness and lifespan compared to products with only one light emitting device. Existing LCDs for vehicles have limitations in that light leak around small content, lowering the contrast ratio, and slowing the response time in a low-temperature environment, leaving an afterimage. On the other hand, LG Display’s self-luminous vehicle OLED has a contrast ratio of 600,000 to 1, which greatly exceeds the certification standard (50,000 to 1) and maintains more than 99% of luminance and color despite rapid changes in the external environment of the vehicle. Also, the response speed is 0.66ms faster than the authentication standard (3ms, milliseconds), so there is no afterimage.

Sohn Ki-hwan, managing director of LG Display Auto Marketing/Product Planning, said “This certification proves that tandem OLED for automobiles is the only display that satisfies the highest picture quality and extreme lifespan”. So “We will provide our customers with a differentiated customer experience with a display that is safer to use while driving and more convenient when stopped” he said.

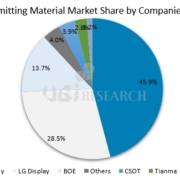

Galaxy Note 20 Ultra with LTPO applied

Galaxy Note 20 Ultra with LTPO applied

http://olednet.com/wp-content/uploads/2021/03/oled4.jpg

http://olednet.com/wp-content/uploads/2021/03/oled4.jpg