In Premium TV market, OLED portion is growing.

Following Bang & Olufsen and SONY, Philips’ OLED TV was launched in Korea on June 11, 2018.

Philips’ OLED TV, applied with LG Display’s OLED panel, is available in two models; 55 – inch and 65 – inch. It features a quad – core CPU, HDR 10, Dolby Vision and DTS surround.

<Philips OLED TV, Source: Philips>

In coming September, Germany’s Loewe plans to launch three (bild5, bild7, bild7 edition) 65-inch OLED TVs using LG Display’s panel, and also Hisense is scheduled to release OLED TV this month.

Especially, when Hisense, which is the leader in the Chinese TV market, releases OLED TVs, it is expected to enhance the awareness about OLED TV in China as well as increase the portion of OLED in the premium TV market.

In April, Kim Sang-don, CFO of LG Display, said in the conference call “The number of existing OLED camps was expanded to 15 from 13, adding two. LG Display will actively respond to increasing market demand by expanding productivity through the reduction of tack time and by converting Chinese fab and, if necessary, domestic LCD fab to OLED fab.”

In the ‘OLED/Display comprehensive seminar’ held by UBI Research, So Hyun-chul, director of Shinhan Financial Investment, said that Sony ranked the first in the premium TV market in 12 years and Sony’s share price rose 445% with its main driving force of OLED TV.

In addition, LG Electronics’ HE division achieved an operating margin of 8.1% last year. In the major set makers, OLED seems to be the Key factor that increases the company’s sales and improves the market share in the premium TV market. As such, OLED portion is anticipated to expand further in the premium TV market.

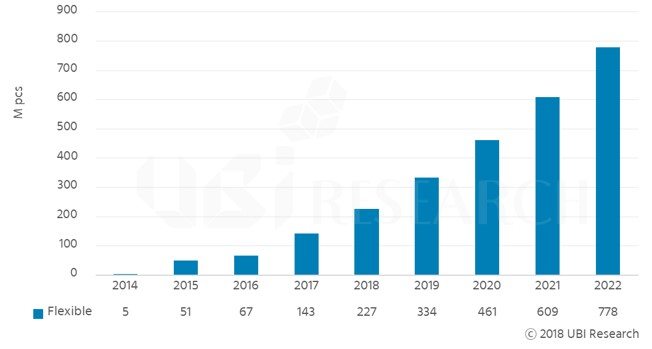

Meanwhile, UBI Research predicts that OLED TV sales will be increased by about 30% annually and the revenue is projected as about US$ 5.7 billion in 2022 through the ‘2018 OLED Panel Industry Report’, which was published in February.