Samsung Display Expands its Business from Smartphones to OLED for IT

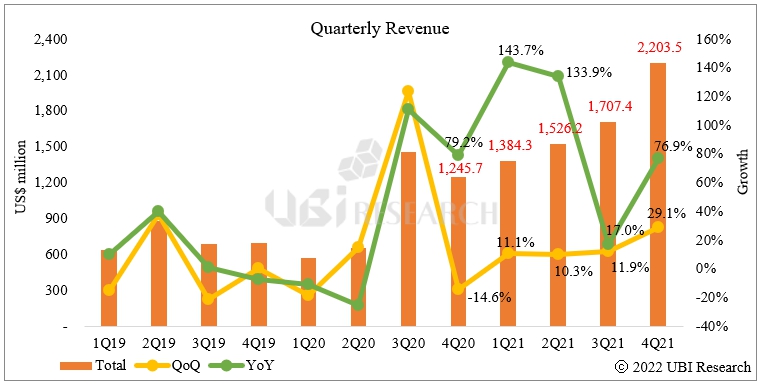

According to UBI Research’s published quarterly report, “1Q22 Medium & Large OLED Display Market Track”, mid-to-large OLED sales in the fourth quarter of 2021 was up 29.1% (QoQ) from the previous quarter at $2.2 billion and up by 76.9% (YoY) from the same period of the previous year.

Although Samsung Display leads the way in the OLED market for mobile devices, LG Display overwhelming dominates the mid to large-sized OLED market.

Of the $2.2 billion in mid to large-sized sales in the fourth quarter of 2021, LG Display’s sales was a massive $1.84 billion, accounting for 83.6% of the market.

By application product, OLED for TVs accounted for 85% of the market with $1.87 billion and OLED for notebook sales accounted for 8.8% of the market at $193 million.

Samsung Display began shipping QD-OLED for TVs and monitors from December 2021.

LG Display announced that it will begin supplying improved OLED EX panels of OLED panels for TV from 2022. LG Display plans to complete preparations for OLED EX production in Paju and Guangzhou by the first quarter of 2022. LG Display has negotiated with Samsung Electronics to supply OLED panels for TVs but no final decisions have been made.

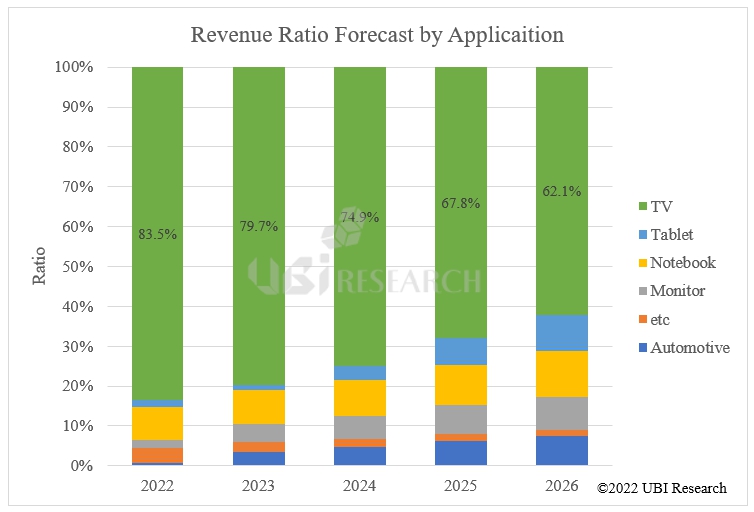

Samsung Display is expanding its OLED business from smartphones to IT applications such as notebooks and tablet PCs. UBI Research predicted the larger than 10-inches, mid-to-large OLED market after 5 years. The TV market, which accounts for 83.5% in 2022, will decrease to 62.1% in 2026. However, the IT market is expected to expand.

“1Q22 Medium & Large OLED Display Market Track” provides data analysis for 10-inches or larger, mid-to-large OLED by examining the current status of OLED production capacity, major panel makers, shipments by application, and sales performance.

In addition, this analysis provides information for major product lines such as automotives, note PCs, monitors, and TVs by evaluating detailed quarterly shipments, sales performances, ASP by application, and OLED supply and demand analysis by application. It projects the market for the next 5 years.