Posts

[China Trend Report] TCL CSOT’s T8 Project to Invest in Generation 8.5 Inkjet Printing Technology

/in Display, Focus on /by olednet

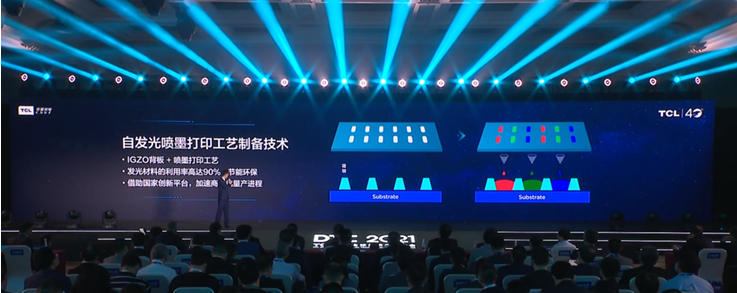

According to the ‘China Trend Report’ published by UBI Research, TCL CSOT plans to apply the generation 8.5 inkjet printing OLED technology to the T8 line. It is expected that some layers will be formed by vapor deposition in the inkjet printing method rather than the complete inkjet printing method. The location is likely to be Guangzhou.

TCL CSOT’s T8 line was scheduled to start construction in March 2022 using the inkjet method, but there were rumors that the schedule continued to be delayed due to investment scale and yield issues. There are also talks about the project being canceled altogether. However, it seems that TCL CSOT has continuously improved its technology by continuously collaborating with JOLED. They also announced related contents at DTC 2021 held in November 2021.

It is is expected that mainly OLEDs for IT and automobiles will be mass-produced at the T8 line. The investment schedule and details of the TCL CSOT T8 project can be found in the ‘March China Trend Report’.

Samsung Display Expands its Business from Smartphones to OLED for IT

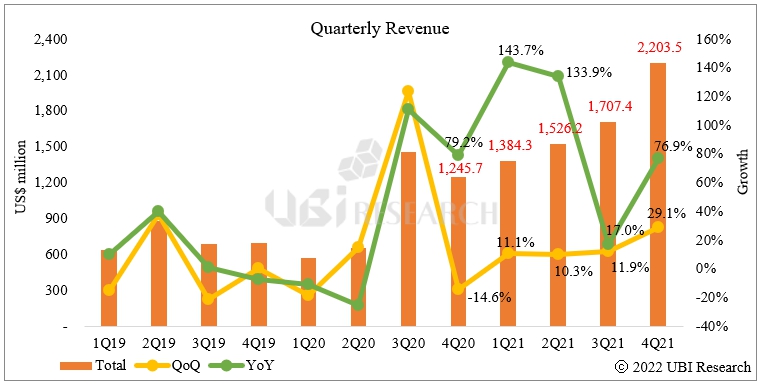

/in Display, Focus on /by olednetAccording to UBI Research’s published quarterly report, “1Q22 Medium & Large OLED Display Market Track”, mid-to-large OLED sales in the fourth quarter of 2021 was up 29.1% (QoQ) from the previous quarter at $2.2 billion and up by 76.9% (YoY) from the same period of the previous year.

Although Samsung Display leads the way in the OLED market for mobile devices, LG Display overwhelming dominates the mid to large-sized OLED market.

Of the $2.2 billion in mid to large-sized sales in the fourth quarter of 2021, LG Display’s sales was a massive $1.84 billion, accounting for 83.6% of the market.

By application product, OLED for TVs accounted for 85% of the market with $1.87 billion and OLED for notebook sales accounted for 8.8% of the market at $193 million.

Samsung Display began shipping QD-OLED for TVs and monitors from December 2021.

LG Display announced that it will begin supplying improved OLED EX panels of OLED panels for TV from 2022. LG Display plans to complete preparations for OLED EX production in Paju and Guangzhou by the first quarter of 2022. LG Display has negotiated with Samsung Electronics to supply OLED panels for TVs but no final decisions have been made.

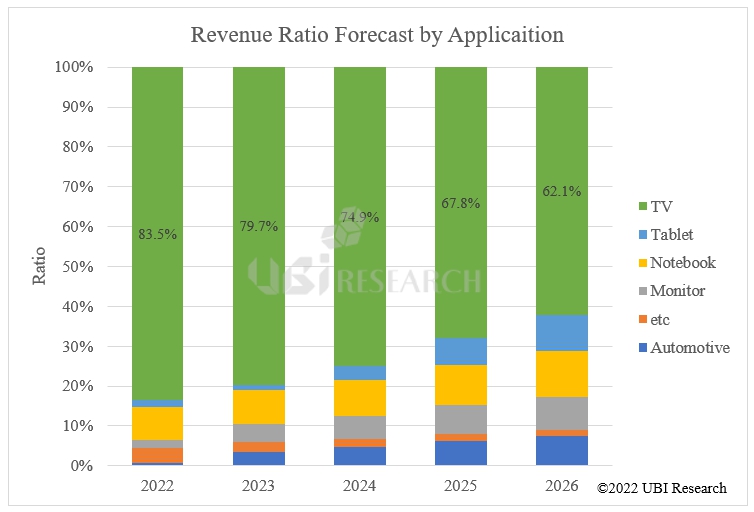

Samsung Display is expanding its OLED business from smartphones to IT applications such as notebooks and tablet PCs. UBI Research predicted the larger than 10-inches, mid-to-large OLED market after 5 years. The TV market, which accounts for 83.5% in 2022, will decrease to 62.1% in 2026. However, the IT market is expected to expand.

“1Q22 Medium & Large OLED Display Market Track” provides data analysis for 10-inches or larger, mid-to-large OLED by examining the current status of OLED production capacity, major panel makers, shipments by application, and sales performance.

In addition, this analysis provides information for major product lines such as automotives, note PCs, monitors, and TVs by evaluating detailed quarterly shipments, sales performances, ASP by application, and OLED supply and demand analysis by application. It projects the market for the next 5 years.

[UBI Research China Trend Report] Chinese Panel Makers’ Total Shipments of OLED Panels for Smartphones in the Fourth Quarter of 2021 Increased by 26% Compared to the Third Quarter

/in Display, Focus on /by olednet26% Increase in Total Shipments of Chinese OLED Panels for Smartphones in the Fourth Quarter compared to the Third Quarter

According to UBI Research’s ‘February 1st China Trend Report’, total shipments of OLED panels for smartphones by Chinese panel makers in the fourth quarter of 2021 were 44.8 million units, a 26% increase from 35.57 million units in the previous quarter. By company, BOE shipped 20.9 million units and occupied a 46.7% share, followed by Visionox with 9.7 million units, EverDisplay Optronics with 5.5 million units, CSOT with 5.5 million units, and Tianma with 3.1 million units.

By substrate, flexible OLED panel shipments were the highest for BOE with 20.9 million units, followed by CSOT with 5.5 million units, Visionox with 4.7 million units, and Tianma with 3 million units. BOE’s panel shipments increased the most compared to the previous quarter with an increase of 5.3 million units, followed by Visionox by 1.9 million units and Tianma by 1 million units. CSOT’s panel shipments decreased by 300,000 units from the previous quarter.

In the field of rigid OLED panel shipments, EverDisplay Optronics shipped 5.54 million units, a decrease of 80,000 units compared to the third quarter, but maintained the No. 1 position in rigid OLED panel shipments with a market share of 52%. Visionox, in second place, shipped 5.04 million units, up 43% QoQ, chasing EverDisplay Optronics. Tianma’s rigid OLED panel shipments were 120,000 units, accounting for only 1%.

The details can be found in the ‘UBI Research China Trend Report’, and inquiries can be made on the UBI Research website.

[UBI Research China Trend Report] BOE dominates OLED shipments for smartphones in October

/in Focus on, Market /by olednetAccording to the ‘China Trend Report for the 1st week of December’ published by UBI Research recently, Among Chinese companies, BOE maintained the No. 1 position with an overwhelming share in OLED panel shipments for smartphones in October.

According to the report, in the flexible OLED shipments by Chinese companies in October, BOE had the most with 5.2 million units, followed by CSOT with 1.6 million units, Tianma with 1 million units, and Visionox with 940,000 units. In terms of market share, BOE was 59%, followed by CSOT, Tianma, and Visionox with 18%, 12%, and 11%, respectively.

As for Rigid OLED shipments, EverDisplay Optronics had the most with 1.7 million units and Visionox mass-produced 950,000 units. In terms of market share, EverDisplay Optronics accounted for 65% and Visionox 35%. Tianma, which previously mass-produced a small amount of rigid OLED, did not mass-produce rigid OLED panels in October.

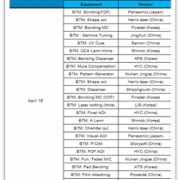

2019 Chinese OLED panel maker equipment order status

/in Equipment, Focus on /by olednetAs Korean OLED panel makers do not have a lot of investment, the OLED equipment industry is in a low-demand season. When Chinese OLED panel makers confirm the order status of equipment orders in 2019, orders are being made centering on equipment and module line equipment required for new technologies rather than new lines.

In China panel makers BOE and CSOT, some equipment was ordered in March of this year for the development of flexible on-cell touch technology, and Korean equipment makers seem to have received orders from Wonik IPS and Iruja. In addition, since last month, the BOE Chengdu line has begun full-scale mass production and ordering of modular products along with foldable product preparation. Korean equipment makers will also receive equipment orders from BOE and proceed with production.

Starting this month, Visionox Hebei Line, which is set to start full-fledged investment this year, has begun placing orders for long-term delivery equipment and automation equipment. In addition, Wuhan Tianma is making some complementary investments in flexible process equipment, and EDO, Royole, and Truly are expected to invest in the future depending on market conditions.

UBI Research AMOLED process equipment industry report, which is scheduled to be published in May 2019, will be covered in detail in investment situation and equipment supply chain in China panel makers.

[BOE Chengdu Module Line Order Status]

OLED Daily Issue, April 25, 2019

/in Focus on, Others /by olednet▶ LGD’s performance is in the doldrums. This year, it will compete with high-value OLEDs. (ZDNet Korea)

(Full text of article: http://www.zdnet.co.kr/view/?no=20190424130827)

While LG Display is recording poor performance in first quarter of this year, it is going to strengthen its competitive edge in OLED display, which is its main business. Because it is expected that Chinese LCD will continue to make inroads into supplies this year, Samsung Display is planning to bring about results through high-value OLEDs that are highly profitable.

“It seems that large OLED business will take up more than 30% of TV business in 2016 through changes in customer and high-end position.” said Seo Dong-hee, chief financial officer of LG Display, during a conference call on the first quarter of 2019.

“Although some fixed expenses are also expected in second half of this year due to preparation of (Guangzhou OLED fab) production infrastructure as planned, we will increase profit contribution starting from 2020.” said a representative for LG Display.

■ It is difficult to rebound in second quarter performance…compete with high-value OLED in second half.

LG Display also expects that its second-quarter earnings will continue to worsen market conditions due to oversupply of LCDs and lack of IT products. Consensus of second quarter’s performance that F& Guide is estimating is $5.58 trillion (5.8181 trillion KRW) in sales and $16 billion (16 billion KRW) in operating loss.

However, it is expecting that it will produce results starting from second half of this year due to operation of OLED production lines that are located in Guangzhou, China, and release effects of transparent and automatic OLEDs.

“We believe that Guangzhou fab will operate successfully during first half of this year. “We are also preparing to apply MMG (Multi Model Glass, which is a method that is produced by combining 55-inch and 65-inch panels) to Guangzhou and Paju fab.” said a representative for LG Display.

Furthermore, transparent OLED products will be released in second half of this year and will expand additional demands. “We are currently working with variety of customers in commercial business.” said a representative for OTO, “Auto is already making more than 1 trillion won in sales through LCD. During this year, you will be able to see vehicles with plastic OLEDs. Although it is difficult to mention exact numbers, South Korea has received a large number of orders for displays for vehicles that employ POLEDs. We believe that orders will also gain considerable momentum when cars with POLED are successfully released this year,” he stressed.

▶ FineTec Receives Intent for Purchase of OLED Bonding Equipment from Chinese Firms(NEWSPIM)

(Full text of article: http://www.newspim.com/news/view/20190424000218)

While demands for OLED panels are increasing rapidly due to the resumption of investments in Chinese OLEDs this year, FineTec is trying to expand its supply of bonding equipment to Chinese display-specialized companies.

FineTec made an announcement on the 24th that it recently received orders from Chinese display company BOE for OLED composite bonding equipment and received LOI (Lent of Purchase of OLED bonding equipment) from CSOT.

FineTec is planning to supply CSOT with equipment dedicated to chips on plastic and COP-COF (chip on film) and other composite equipment that can be produced simultaneously. It is predicted that it will sign a contract with CSOT to supply bonding equipment after discussing detailed timing of supply.

In addition, FineTec, which is currently seeking to diversify its suppliers to China, is planning to strengthen its competitive edge in operation such as OLED composite bonding equipment for CSOT starting with this contract.

“Chinese OLED panel manufacturers are increasing their market share thanks to government support and Chinese Smartphone manufacturers’ promotion.” said a representative for this company. “FineTec is planning to focus on improving performance by securing orders from Chinese suppliers as China is actively seeking to increase its market share in OLED.”

It is also expected that FinTec’s combined bonding equipment will expand its competitive edge in markets in China. Although FinTec had about 10% of orders for bonding equipment that was placed in China three years ago, percentage of orders from Chinese display companies such as BOE and Visionox increased to 26% last year due to increased demands for composite equipment.

“We are currently converting variety of display panels from facilities that are targeted at specific types of panels from China and around the world into multi-functional equipment that can be produced at the same time.” said a representative for Samsung Electronics.

OLED Daily Issue, April 22, 2019

/in Focus on, Others /by olednet▶ OLED is also worried about oversupply…” China factory size, twice that of Korea.” (YONHAP NEWS)

(Full text of articles: https://www.yna.co.kr/view/AKR20190419148900003?input=1195m)

Following LCD panels, there are predictions that oversupply can become a reality for OLED panels.

Concerns are growing as South Korean companies plan to grow OLEDs into new “cash cow” instead of LCDs that China has taken the lead.

According to a recent report released by Hana Financial Management Research Institute on 21th, the number of OLED panel factories currently under construction in China is 419,000 sheets per month, about twice the amount of 225,000 sheets per month, which is the size of South Korea’s expansion.

According to the report, China’s BOE, which ranks first in LCD panel market, is going to increase its size to 144,000 panels. In addition, Chinese panel manufacturers such as CSOT, Visionox, and TCL are also scrambling to expand their facilities on a large scale.

Among South Korean companies, LG Display is set to operate its 90,000-unit monthly plant in Guangzhou, China, and it is expected that there will be a total of 45,000 panels per month in Paju.

Industries predict that size of OLED plant that will be built by Samsung Display in Tangjeong, South Chungcheong Province, will reach 90,000 sheets per month.

“As speed of expansion of OLEDs in South Korea and China is much faster than rate of increase in demands, there is a high possibility that oversupply will worsen.” said Joo-wan Lee, a researcher.

▶ The screen shield that caused controversy over faulty Galaxy folds…Why do I need it? (Yonhap news)

(Full text of articles: https://www.yna.co.kr/view/AKR20190421010700017?input=1195m)

Samsung Electronics’ first foldable Smartphone was embroiled in controversy over its screen defects even before it was released. Samsung Electronics explains that this happened because early users removed “screen protection film,” which can be misunderstood as screen protection film.

<Samsung Electronics [Samsung Electronics Co., Ltd.]>

OLED panels themselves are very thin like vinyl and are weak against external shocks. Plastic OLED (Plastic OLED) that is used for foldable Smartphones is more vulnerable to scratch. However, it can’t put glass, which is a material that doesn’t fold, so it is finished by applying film of plastic material.

“Although screen protection films that we already know are additional products that prevent scratching, protective films that are used for flexible displays are very important for displays.” said Professor Hak-seon Kim of UNIST, who is a former vice president of Samsung Display. Ok-hyun Jeong, an electronic engineering professor at Sogang University, also said, “The fact that we took out a protective film from PLED is tantamount to ripping off the display parts themselves.”

OLEDs emit light as organic materials, and due to their characteristics, they are very susceptible to oxygen and moisture components. When a thin panel itself is subjected to strong pressure during a screen’s opening, it can cause the screen itself to become indigestion due to moisture in an empty space.

Plastic has a weaker hardness than glass, making it easier to scratch the surface.

In addition to screen glitches, the media that received Galaxy Folders for review such as Bloomberg and Derverge points out that the protective film is easily dented or scratched. One reviewer said, “I tapped the screen with my fingernails, but there are still permanent marks.”

Some point out that there is a gap between the protective film and the display, which makes it easier for dust and others to get rid of it. One reviewer suggested a photo showing the gap between the screen’s protective screen and bezel, suggesting that it could be misleading.

Due to this reason, Samsung Electronics explained that its screen shield is for ‘replacement’. Since there is a higher chance of damage such as scratch than conventional glass, they were made so that they could be replaced at that time. However, users should not replace them directly and go through a service center.

Experts point out that such precautions should be sufficiently notified to consumers before the launch, and that early users also need to follow basic precautions as they use first-generation products.

Jeong said, “Samsung Electronics seems to have lacked notice of screen protection. “We need to strengthen advance notice when it is officially released.” said a person who dropped it from the company, which is about 100 grams more than normal Smartphones, risks further damage when it is dropped from the same location. This part also requires the user to pay attention,” he pointed out.

“Since the film itself is a plastic material, even if it is attached with protective film, it can be pierced and torn if exposed to sharp needles, unlike glass,” Professor Kim said. “In fact, these precautions should be properly introduced when selling it.”

▶ SK is investing in OLED business? (etoday)

(Full text of articles: http://www.etoday.co.kr/news/section/newsview.php?idxno=1747027)

SK Corp. is considering investing into OLED material business. As OLED markets are rapidly growing, industries that are made of OLED materials are also increasing.

According to mid- and long-term management plan data that SK Corp. held a corporate briefing for analysts of securities companies on Wednesday, SK Corp. is also reportedly considering investing in OLED materials to expand its material business.

SK Corp. has set a mid- and long-term strategy for its material business to expand its high-growth area by utilizing its current material platform.

For OLED materials, LG Display is planning to develop its own technologies by linking current SK Trichem’s technologies such as precursors and others while also considering investing in them.

Industries predict that SK Corp. will be able to expand its business through investments as it is an investment-type holding company.

For battery materials, which are planning to enter markets with high-entry barrier materials through partner companies’ cooperation and investment in technology holding companies, it has quickly entered the market by investing 270 billion won into shares of related companies.

SK Corp. previously acquired the stake in Watson, China’s No. 1 company that manufactures the second-order essential part of the battery, in November last year.

A reason why SK is showing interest in OLED markets is because OLED markets are growing rapidly.

According to a market research company called Ubi Research, size of OLED display market was estimated to be $28.31 billion (31.9568 trillion KRW) last year, which is a 7.1% increase year-on-year and is expected to grow to $32.3 billion (36.457 trillion KRW) this year.

It is expected to grow to $59.5 billion by 2023.

As a result, many other companies are working on OLED materials. Earlier this month, LG Chem stepped up its related business by acquiring material technology for “Solid Organic Light Emitting Diodes,” a key platform for next-generation displays, from DuPont in the U.S.

Doosan also established a new company through division of its business sector to strengthen its material businesses such as OLED.

“We have no specific plan to invest in OLED materials yet.” said a representative for SK Corp.

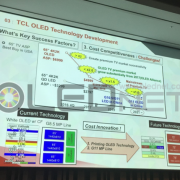

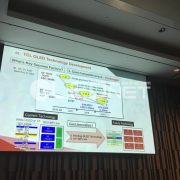

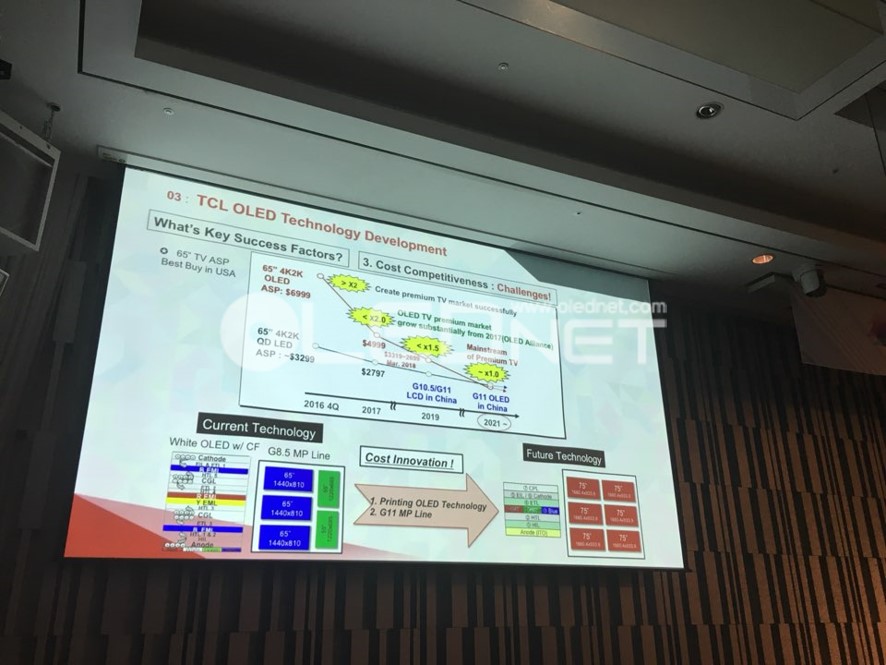

TCL announced “Establishing large-area OLED panel production plant”, is solution processed RGB OLED mass production accelerated?

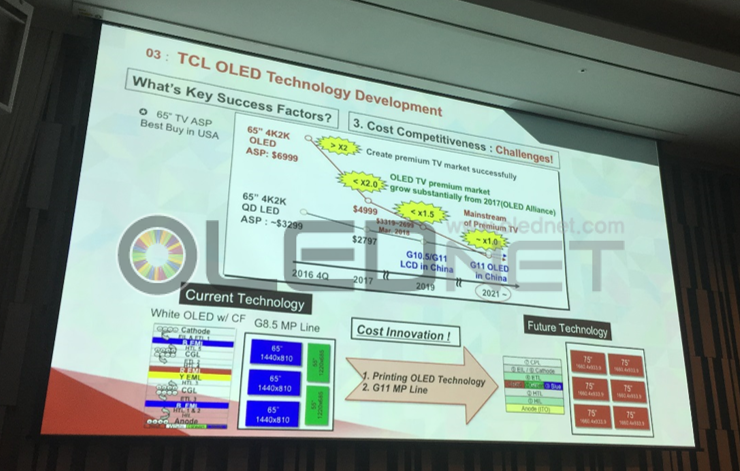

/in Others /by OLEDNETChina TCL will invest RMB 42.8 billion (US$ 6.71 billion) in Shenzhen to establish a factory for large-area OLED panel production. According to South China Morning Post, TCL recently announced that it will produce 90,000 units on the basis of 70-inch panel in the new production line of Gen 11 (3370 mm x 2940 mm) with the goal of mass production in March 2021 in the data submitted to the Shenzhen Stock Exchange. The main products are to be known as 65-inch and 75-inch OLED panels, and 65-inch, 70-inch and 75-inch display panels with 8K resolution.

TCL will form a partnership with the China Development Fund for the necessary financing and will set up a new production line at TCL’s semiconductor subsidiary with RMB 20.3 billion.

Large-area OLED to be produced by TCL is expected to adopt solution process RGB. At the ‘4th OLED Korea conference’ hosted by UBI Research in March, James Lee, deputy chief engineer of TCL mentioned about the development of next-generation premium TV with the screen size of 70-inch or more and 8K resolution, based on the solution process.

Lee said, “The price difference between OLED TV and premium LCD TV is estimated to be reduced to 1.4 times when the price of large-area OLED panel is lowered by the operation of LG Display’s Gen 10.5 plant in 2020. We are developing solution process technology for large area OLED and it will be applicable to Gen11 factory. ”

Gen 11 production line is capable of producing six sheets of 75-inch OLED panels, being able to achieve a yield three times higher than Gen 8.5 production line and a cutting efficiency of over 95%. In addition, it is possible to produce large-area OLED panels with a real RGB structure instead of the WRGB structure when solution process is applied. Based on this, TCL emphasized that the construction of the Gen 11 solution process OLED mass production line is essential. Meanwhile, TCL has jointly established JUHUA Printing Display Technology with Tianma, a Chinese company, in 2016 through CSOT, which is a subsidiary of TCL, and is continuously developing the inkjet printing process by a Gen 4.5 R&D pilot plant.

TCL “대면적 OLED panel 생산 공장 신설” 발표, solution process RGB OLED 양산 가속화 되나

/in 미분류 /by OLEDNET중국 TCL이 선전에 428억 위안(67억 1천만 달러)을 투자하여 대면적 OLED panel 생산을 위한 공장을 신설한다.

사우스차이닝모닝포스트에 의하면, TCL은 최근 선전 증권거래소에 제출한 자료에서 2021년 3월 양산을 목표로 Gen 11(3370 mm x 2940 mm) 신설 양산 라인에서 70 inch panel 기준으로 월 9만대를 생산한다고 밝혔다. 주력 제품은 65 inch와 75 inch OLED panel과 8K 해상도의 65 inch, 70 inch, 75 inch display panel 인 것으로 알려졌다.

TCL은 자금 조달을 위해 중국 지원 개발 기금과 파트너쉽을 맺을 것이며, TCL 반도체 자회사에서 203억 위안을 들어 새로운 생산 라인을 설립 할 것으로 알려졌다.

TCL이 생산 할 대면적 OLED는 solution process RGB 방식일 것으로 예상된다. 지난 3월 유비리서치가 주최한 ’4th OLED Korea conference’에서 TCL의 James Lee deputy chief engineer는 solution process를 기반으로 70 inch 이상의 대형 화면과 8K 해상도의 차세대 premium TV 개발을 언급한 바 있다.

Lee deputy chief engineer는 “2020년 LG Display의 Gen 10.5 공장이 가동되어 대면적 OLED panel의 가격이 하락하게 되면 OLED TV와 premium LCD TV의 가격 차이는 1.4배 수준까지 줄어들 것으로 예상된다”며, “TCL은 현재 대면적 OLED용 solution process 기술을 개발 중으로 Gen11 공장에 적용이 가능할 것”이라고 밝혔다.

Gen 11 생산 라인에서는 75 inch OLED panel이 6장 생산 가능하며, Gen 8.5 생산 라인 대비 3배 증가한 생산량과 95% 이상의 면취율 달성이 가능하다. 또한, solution process 적용 시 WRGB 구조가 아닌 real RGB 구조의 대면적 OLED panel 생산이 가능하다. TCL은 이를 바탕으로 Gen 11 solution process OLED 양산라인 건설이 필수 요소라고 강조한 바 있다.

한편, TCL은 산하 업체인 CSOT를 통해 2016년 중국 기업 Tianma와 함께 JUHUA Printing Display Technology라는 합작사를 설립, 4.5세대 R&D 파일럿 공장을 만들어 잉크젯 프린팅 공정을 지속적으로 개발하고 있다.

Following OLED, notch design to LCD becomes a marketing trend in 2018?

/in Exhibition /by OLEDNETAt the 6th China Information Technology Expo (CITE 2018) held in Shenzhen, Guangdong Province, China from April 8 to 11, 2018, a number of panel makers and set makers exhibited notch-designed display panels and smart phones.

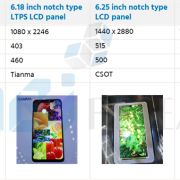

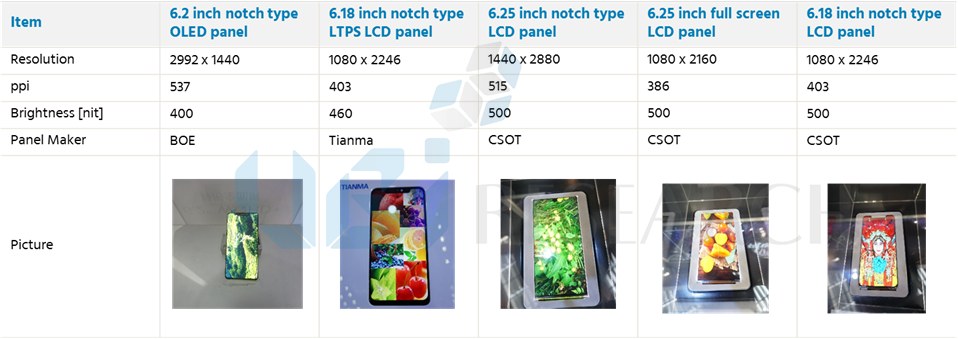

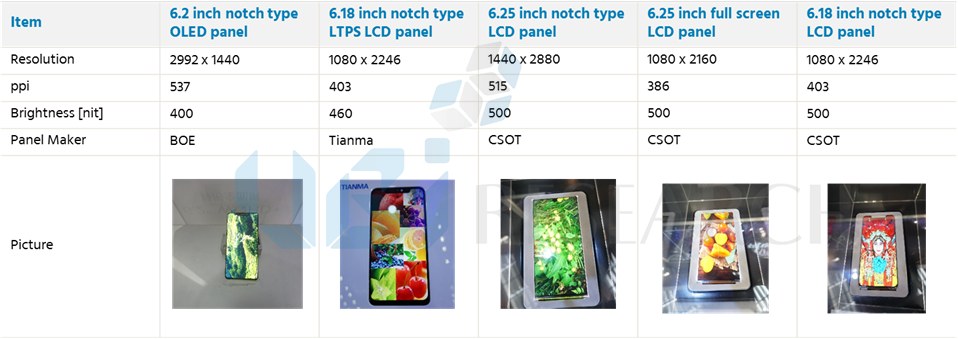

In CITE 2018, five panel manufacturers exhibited in CITE 2018; BOE, EDO, GVO, Tianma and CSOT. Among them, BOE, Tianma and CSOT exhibited notch-designed display panels.

First, BOE introduced 6.2-inch OLED panels applied with notched design. The OLED panel exhibited by BOE has a resolution of 2992 x 1440 with 537 ppi and 400 nit brightness.

LCD panels also began to adopt Notch Design. Tianma presented a 6.18-inch LCD panel with a notch design. CSOT also exhibited two 6.25-inch LCD panels and a 6.18-inch LCD panel applied with notched design.

<’Notch design’ display panels exhibited in CITE 2018>

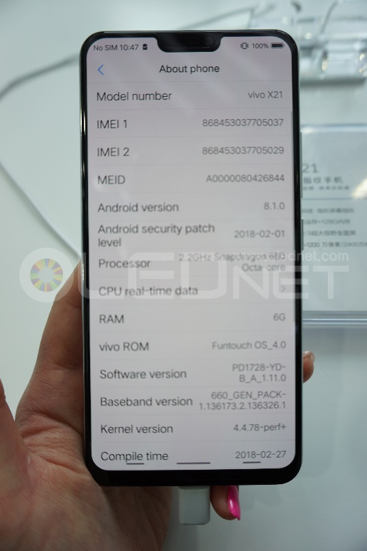

Vivo, a Smartphone maker, also exhibited the X21 with a notch design. The X21, released in March, has a resolution of 1080 x 2280 with 6.28 inch screen.

<Vivo X21, OLED Smartphone with notch design>

Since Apple first unveiled its OLED smart phone with the notch design on iPhone X, a number of smart phone makers such as Vivo, Oppo, and Huawei have begun to release OLED smart phones. In this exhibition, many panel makers presented a large number of LCD panels to which Notch Design is applied. Attention is growing whether Notch Design can become a trend in the small and medium sized display market in 2018.

OLED에 이어 LCD까지 노치 디자인 적용, 2018년 대세로 자리매김 하나

/in 미분류 /by OLEDNET2018년 4월 8일부터 11일까지 중국 광둥성 선전에서 개최 된 제 6회 중국정보기술엑스포(China information technology expo, 이하 CITE 2018)에서 다수의 패널업체와 세트 업체들이 노치 디자인이 적용 된 디스플레이 패널과 이를 이용한 스마트폰을 전시하였다.

CITE 2018에서는 BOE와 Tianma, CSOT, EverDisplay Optronics, GVO 등 총 5개의 업체가 디스플레이 패널을 전시하였으며, 그 중 BOE와 Tianma, CSOT가 노치 디자인이 적용 된 디스플레이 패널을 전시하였다.

먼저, BOE는 노치 디자인이 적용 된 6.2인치 OLED 패널을 선보였다. BOE에서 전시한 OLED 패널의 해상도는 2992 x 1440 이며 537 ppi, 밝기는 400 nit다.

LCD 패널도 노치 디자인 대열에 합류하기 시작했다. Tianma는 노치 디자인이 적용 된 6.18인치 LCD 패널을 선보였으며, CSOT도 노치 디자인이 적용 된 6.25인치 LCD 패널 2개와 6.18인치 LCD 패널 1개를 전시하였다.

<CITE 2018에서 전시 된 노치 디자인 디스플레이 패널>

또한, 스마트폰 세트 업체인 Vivo도 노치 디자인이 적용 된 X21을 전시하였다. 3월에 출시 된 X21은 6.28 inch에 1080 x 2280 해상도가 적용되었다.

<노치 디자인이 적용 된 OLED 스마트폰인 Vivo X21>

Apple이 iPhone X에 노치 디자인이 적용 된 OLED 스마트폰을 처음 선보인 이후, Vivo와 Oppo, Huawei 등 다수의 스마트폰 제조사들이 OLED 스마트폰을 잇따라 출시하기 시작하였다. 이번 전시회에서는 다수의 패널 업체들이 노치 디자인이 적용 된 LCD 패널들도 다수 전시함에 따라, 노치 디자인이 2018년 중소형 디스플레이 시장에서 대세로 자리매김 할 수 있을지 관심이 집중되고 있다.

LG Display 88-inch 8K OLED TV was released to the public through CITE held in Shenzhen, China.

/in Exhibition /by OLEDNETCITE, an electronics trade show held in China on April 10, 2018, had a relatively lukewarm atmosphere with significantly fewer visitors than last year. It seems to have been influenced by the lack of special IT issues, compared to last year when it was crowded with the attention of many general visitors.

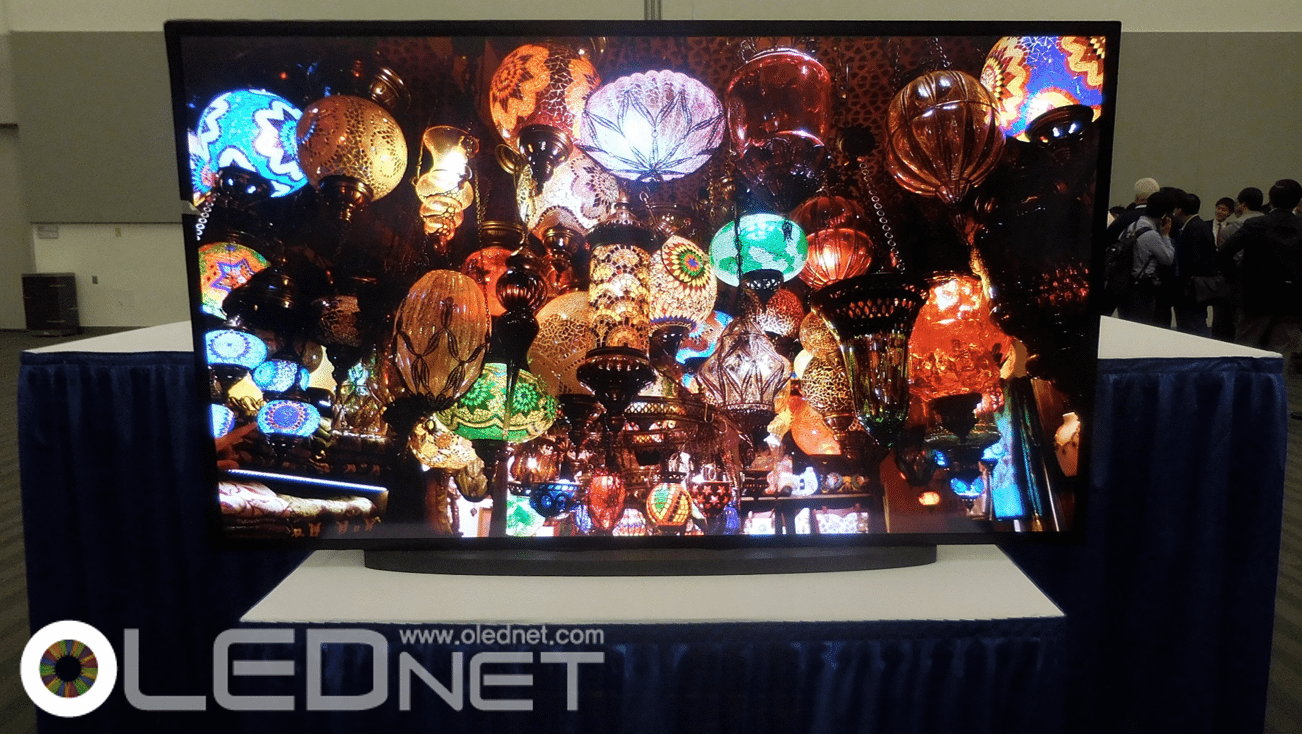

Especially, there were no new products on the TV appliance side. Most of the exhibitors displayed the same products as those of last year or 2018 CES. On the other hand, LG Display unveiled its 88-inch 8K OLED TV, which had been hiding in its own booth, at the front of the booth. CSOT also showcased OLED displays made with printing technology that had been publicized several times during several conferences. 8K OLED TV is to be the future of the high-end premium TV as it clearly shows the advantages of OLED display such as contrast ratio, sharp image quality and color reproduction through large screen. CSOT’s 31-inch display is meaningful because it exhibited the results of CSOT’s printing OLED technology development. It is preparing for a new investment of about 20K TV line next year. The exhibited product was manufactured by using top emission Ink-jet printing technology to oxide TFT. The peak brightness is 150 nit at 144 ppi.

<88 inch 8K OLED TV – LG Display>

<31inch Ink-jet printed OLED Display – CSOT>

Vivo, which was the first to unveil the smart phone X21 with a built-in fingerprint sensor, displayed only the X21 model at its booth. As a result of the actual registration testings, the fingerprint was recognized several times compared to the existing fingerprint registration, and the test recognition rate was not bad, but the response speed was slightly slower than opening the screen with the home button. In addition, most panel makers exhibited displays similar to the notch design of the iPhone X, which created various issues over the past six months, and set makers such as Vivo and Oppo released similar notch type smart phones. According to one official of some panel maker, the response to the design is not positive, but he said the company made it along with Apple. In his personal opinion, he preferred full screen design. Despite the sluggish performance of iPhone X, it still shows Apple’s strong market influence that the smart phones of the similar designs were released.

BOE, which started the operation of its Chengdu factory in 3Q 2017, exhibited various OLED panels made using plastic substrates. One official of BOE expressed confidence that it is only Samsung Display and BOE that can mass produce flexible OLED panels using plastic substrates across the globe.

LG 디스플레이 88인치 8K OLED TV 중국 심천 CITE를 통해 대중에 공개

/in 미분류 /by OLEDNET2018년 4월 10일 중국에서 개최된 전자제품 전시회인 CITE는 작년에 비해 눈에 띄게 적은 참관객들로 비교적 한산한 분위기다. 특히 비즈니스가 아닌 일반 참관객들의 관심을 받아 북적이었던 작년에 비하면 특별한 IT 이슈가 없었던 영향이 아닌가 싶다.

특히 TV 가전 쪽에서는 이렇다할 신제품이 선보이지 않았다. 대부분 작년 혹은 2018 CES 와 같은 제품을 전시한 정도이다. LG디스플레이는 그동안 프라이빗 부스에 숨겨왔던 88인치 8K OLED TV를 부스 전면에 공개하였으며 CSOT은 그동안 여러 차례 컨퍼런스 발표를 통해 공개해왔던 프린팅 기술로 제작한 OLED 디스플레이를 공개했다. 8K OLED TV는 명암비, 선명한 화질, 색감 등 OLED 디스플레이의 장점을 대형화면을 통해 뚜렷이 드러내면서 프리미엄 TV의 모습을 보여주었다. CSOT의 31인치 디스플레이는 그 품질보다 내년 약 20K TV라인 신규 투자를 준비하고 있는 CSOT의 프린팅 OLED 기술개발의 성과를 전시했다는 것에서 그 의미가 있다. 전시한 제품은 옥사이드 tft에 전면 발광 Ink-jet프린팅 기술로 제작하였으며 144 ppi에 피크휘도 150 nit이다.

<88인치 8K OLED TV – LG Display>

<31인치 Ink-jet printed OLED Display – CSOT>

얼마전 공개한 지문인식센서 내장 디스플레이를 채용한 스마트폰X21을 세계최초로 공개한 Vivo는 이번 전시에도 X21모델만으로 부스전시를 진행하였다. 실제 지문등록을 해보니 기존 지문 등록보다 여러 차례에 걸쳐 지문을 인식하였으며 테스트 인식률은 나쁘지 않았으나 홈버튼으로 화면을 여는 것에 비해 응답속도가 조금 늦다는 것을 느낄 수 있었다.

또한, 지난 약 6개월간 다양한 이슈를 만든 아이폰 X의 노치디자인과 비슷한 디스플레이를 대부분의 패널 업체에서 전시하였으며 Vivo와 Oppo 등 세트업체에서도 비슷한 노치디자인의 스마트폰을 공개하였다. 한 패널업체의 관계자에 따르면 디자인에 대한 반응은 긍정적이지 않다고 생각하지만 애플을 따라 제작 했다고 하였으며, 개인적인 의견으로는 Full Screen 디자인을 선호한다고 하였다. 아이폰 X의 실적과 관련한 부정적인 상황에도 불구하고 같은 디자인의 스마트폰들의 공개를 통해 여전히 애플의 시장 영향력이 크다는 것을 보여주고 있었다.

지난해 3분기 Flexible OLED 청두 공장 가동을 시작한 BOE는 플라스틱 기판을 사용해 제작한 다양한 OLED 패널을 전시하였다. 특히, 한 전시관계자는 전세계에서 플라스틱 기판을 사용한 Flexible OLED 패널을 양산할 수 있는 곳은 삼성디스플레이와 BOE 밖에 없다고 전하며 자신감을 내비쳤다.

Flexible OLED Leading the OLED Panel Market from 2019

/in Market /by OLEDNET■ Flexible OLED is expected to ship 480 million units in 2019, surpassing Rigid OLED shipments.

■ Full-screen OLED among Flexible OLED is expected to have an average market share of 78.3% by 2022, dominating the market.

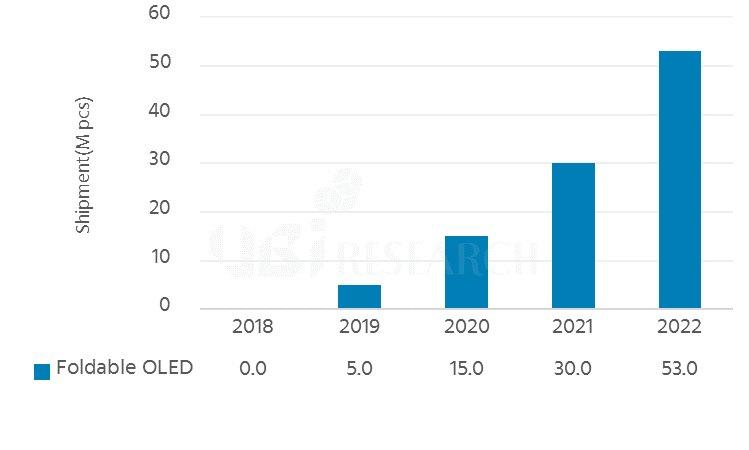

■ Foldable OLED is expected to ship in earnest from 2019.

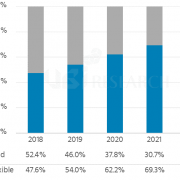

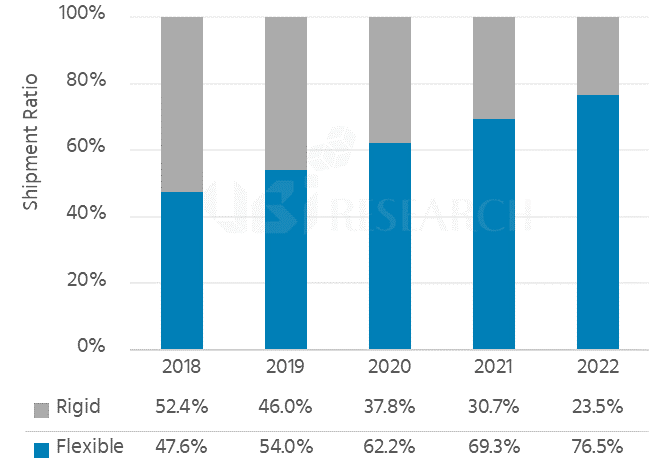

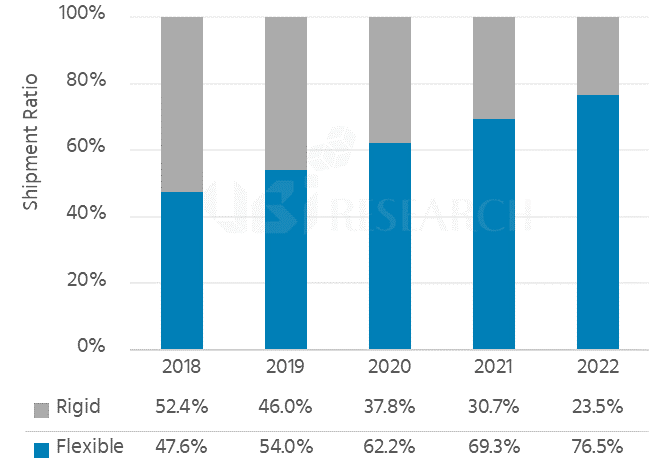

Flexible OLED shipments are expected to exceed rigid OLED shipments in 2019. According to the ‘2017 Flexible OLED Annual Report’ published by Ubi Research, flexible OLEDs are expected to ship 480 million units in 2019, surpassing 409 million units of rigid OLED shipments. In addition, flexible OLED shipments will grow at a CAGR of 41% starting in 2018, reaching 1,285 million units in 2022 with forecasted revenue of US$ 59.4 billion.

<OLED Market Share Forecast by Substrate in 2018 ~ 2022>

Recently, as the hardware technology of mobile devices has been leveled up, set makers targeting the premium market are trying to differentiate their products by adopting OLED. Especially, set makers are beginning to introduce flexible OLED capable of full screen, as the needs of consumers who want a wider screen in mobile devices (even in the same sizes) on the increase.

Accordingly, panel makers are continuing to invest in flexible OLED mass production. Since Chinese panel makers such as BOE, CSOT and Visionox are expected to start mass production of Gen6 flexible OLED starting in 2018, flexible OLED shipments will likely grow at an average growth rate of 59% per annum, reaching 354 million units by 2022.

This report compares the structure and process of rigid OLED and flexible OLED, and analyzes the trends of technology development for foldable OLED implementation by layer. It also compares the flexible OLED application technology of Samsung Electronics, Apple, and LG Electronics which released mobile devices with full screen OLED. The report also forecasts the flexible OLED market from 2018 to 2022 by categorizing into various perspectives including flexible type, country and generation.

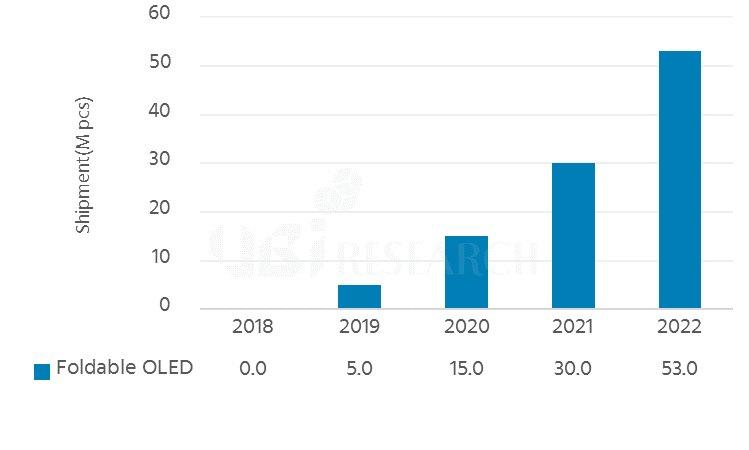

According to the report, full screen OLEDs of flexible OLEDs will ship 265 million units in 2018 with a market share of 82.1%, and 1,022 million shipments will be made in 2022, accounting for 79.5% of the market, leading the flexible OLED market. In addition, the foldable OLED, which has been receiving a great deal of attention recently, is expected to ship 5 million units from 2019 and 53 million units by 2022.

<Foldable OLED Shipment Forecast in 2018~ 2022>

Flexible OLED 2019년을 기점으로 OLED Panel 시장 주도

/in 미분류 /by OLEDNETFlexible OLED 출하량이 2019년에는 rigid OLED의 출하량을 넘어설 것으로 전망됐다. 유비리서치가 발간한 ‘2017 Flexible OLED Annual Report’에 따르면, flexible OLED는 2019년에는 4억 8,000만개가 출하되어 4억 900만개의 rigid OLED 출하량을 넘어설 것으로 전망했다. 또한, Flexible OLED 출하량은 2018년부터 연평균 41% 성장하여 2022년에는 12억 8,500만개 규모를 형성하고 매출액은 594억 달러를 기록할 것으로 예상했다.

<2018~2022년 OLED 기판별 시장 점유율 전망, 출처: 유비리서치>

최근 Mobile 기기의 하드웨어 기술이 상향 평준화 되면서 premium 시장을 목표로 하는 set 업체들은 OLED를 채용하며 제품 차별화를 시도하고 있다. 특히, 같은 size의 mobile 기기에서도 더 넓은 화면을 원하는 소비자들의 니즈가 증가함에 따라 set 업체들은 full screen이 가능한 flexible OLED를 도입하기 시작하였다.

이에 따라 panel 업체들도 flexible OLED 양산을 위한 투자를 지속적으로 진행하고 있다. 특히, 2018년부터 BOE와 CSOT, Visionox 등 중국 panel 업체의 Gen6 flexible OLED 양산 투자가 본격적으로 시작될 것으로 예상됨에 따라, 중국의 flexible OLED 출하량은 연평균 59% 성장해 2022년에는 3억 5,400만개에 달할 것으로 전망됐다.

본 보고서에서는 rigid OLED와 flexible OLED의 구조와 공정을 비교하고 foldable OLED 구현을 위한 기술개발 동향을 layer별로 분석하였다. 또한, full screen OLED가 적용 된 mobile 기기를 출시한 Samsung Electronics와 Apple, LG Electronics의 flexible OLED 적용 기술을 비교하였으며 2018년부터 2022년까지의 flexible OLED 시장을 flexible type과 국가별, 세대별 등 다양한 관점에서 분류하여 전망하였다.

본 보고서에 따르면, flexible OLED 중 full screen OLED는 2018년 2억 6,500만개가 출하되어 82.1%의 시장 점유율을 차지하고 2022년에는 10억 2,200만개가 출하되어 79.5%의 점유율을 차지하며 flexible OLED 시장을 주도할 것으로 전망하였다. 또한, 최근 큰 주목을 받고 있는 foldable OLED는 2019년부터 500만개가 출하되고 2022년에는 5,300만개가 출하될 것으로 예상하였다.

<2018~2022년 Foldable OLED 출하량 전망, 출처: 유비리서치>

IoT Era – Smart interface focused on display

/in Exhibition /by OLEDNET

With the Google’s comments in 2015 that the new IoT era is coming, the 13th China International Display Conference started with the presentation of BOE, a large Chinese display company, with the topic of the era of smart interfaces to be developed in the future.

Randy Chen (BOE, Sales Marketing Executive) shared the overall IT market trend as the first presentation and delivered the BOE’s strategy within it. At the heart of the IOT industry, which is expected to account for around $ 10 trillion in 2050, smart interfaces that link 5G communications and electronics to displays will play a big role and emphasized 8K and flexible display as BOE’s survival strategy. For this, he announced that they are working to build the 8K Industry Alliance and continuing to invest in the production of flexible displays starting with Chendu’s G6 Flexible Line. OLED panels produced in the Chendu B7 line, which began operating in the second half of this year, will be supplied to a smartphone maker in Shenzhen and expected to be seen in the market early next year.

Next, Xiuqi Huang (GVO, Vice President) of Visionox, who first started producing OLEDs starting with PMOLED, mentioned the change of smartphone trend and said that a mobile device with a foldable and rollable type using a flexible panel will be introduced in the future. He said that the technological development is required not only in design but also in related equipment and materials and Visionox has also been actively developing its technology.

CSOT, which produces QD-LCDs together with Samsung Display, mentioned the development potential of QLED and OLED TV and said that it was spurring technological development and investment as a latecomer. Especially, it was developing large-area inkjet printing technology that has advantages of relatively high material utilization rate and price competitiveness, on the other hand, it shared the goal of developing a smartphone panel that minimizes Bezel.

Following the presentation of representative panel companies in China, Lee Choong-hoon of Ubi Research, a global OLED research company, forecasted the market size of the OLED market, which is already leading the small-medium-sized panel market and the premium TV panel market and discussed why OLEDs have grown rapidly as a next-generation display. Ubi Research, as an OLED professional research company, is suggesting directions for future growth of OLED based on years of data and research experience.

In current display industry, major global smartphone makers such as Apple, Samsung and Huawei already have plans to apply OLED to all flagship models and TV companies such as LG Electronics and Sony have also shown that OLED TVs can only succeed in the premium market. This is why we expect the development of various types of panels and various applications that maximize the advantages of OLED forward.

IoT 시대 – 디스플레이를 중심으로 한 스마트 인터페이스

/in 미분류 /by OLEDNET

새로운 IoT 시대가 온다는 2015년 Google의 말을 빌려 앞으로 진행될 스마트 인터페이스의 시대를 토픽으로 한 중국 대형 디스플레이업체인 BOE의 발표로 13회 China International Display Conference가 막을 올렸다.

Randy Chen(BOE, 영업마케팅 총괄)은 첫번째 발표답게 전체적인 IT시장의 흐름을 공유하며 그 안에서 BOE의 전략을 전달했다. 2050년 약 10 조 달러의 규모를 형성할 것으로 예측되는 IoT 산업의 중심에는 5G 통신과 전자기기를 디스플레이로 연결하는 스마트 인터페이스가 큰 역할을 할 것이며 BOE의 생존전략으로 8K와 플렉서블 디스플레이를 강조했다. 이를 위해 8K 산업연맹을 구축하기 위해 노력중이며 Chendu의 G6 플렉서블 라인을 시작으로 플렉서블 디스플레이 생산을 위한 지속적인 투자를 진행하고 있다고 발표 했다. 올해 하반기 가동을 시작한 Chendu B7 라인에서 생산되는 OLED 패널은 심천의 한 스마트폰 업체에 공급되어 내년 초 시장에서 볼 수 있을 것으로 기대된다.

이어 PMOLED를 시작으로 가장 먼저 OLED 생산을 시작한 Visionox의 Xiuqi Huang(GVO, Vice President)는 스마트폰 트렌드의 변화를 언급하며 앞으로 플렉서블 패널을 적용한 폴더블, 롤러블 형태의 모바일 기기가 등장할 것임을 얘기했다. 플렉서블 패널의 다양한 형태 변화를 통해 디자인 뿐만 아니라 관계된 장비와 소재들에도 기술 개발이 필요하며 Visionox 또한 기술개발을 활발히 진행중인 것으로 밝혔다.

삼성디스플레이와 함께 대표적으로 QD-LCD를 생산하고 있는 CSOT는 QLED와 OLED TV의 발전가능성을 함께 언급하며 후발주자로서 기술 개발과 투자에 박차를 가하고 있다고 전했다. 특히 상대적으로 높은 재료 사용률과 가격 경쟁력의 장점을 가지고 있는 대면적 잉크젯 프린팅 기술 개발에 힘쓰고 있으며 한편으론 Bezel을 최소한으로 줄이는 스마트폰용 패널 개발 목표에 대해서도 공유하였다.

중국 대표 패널회사들의 발표에 이어 글로벌 OLED 리서치회사 유비리서치의 이충훈 대표는 이미 중소형 패널 시장과 프리미엄 TV 패널 시장을 주도하고 있는 OLED 시장의 시장규모를 전망하고 OLED가 왜 차세대 디스플레이로서 빠른성장을 할 수 있었는지에 대해 논의하였다. 유비리서치는 OLED 전문 리서치 업체로서 수년간에 걸친 데이터와 리서치 경험을 토대로 OLED가 앞으로 성장할 방향을 제시하고 있다.

현재 디스플레이산업에서는 애플과 삼성, 화웨이 등 전세계 주요 스마트폰 업체들에서 이미 플래그십 모델을 모두 OLED를 적용하려는 계획을 가지고 있으며 LG전자와 소니 등 TV 업체들도 OLED TV가 프리미엄 시장에서 성공할 수 밖에 없다는 것을 보여주고 있다. 이는 앞으로 OLED가 가진 장점을 극대화한 다양한 형태의 패널과 다양한 어플리케이션의 발전이 기대되는 이유이다.

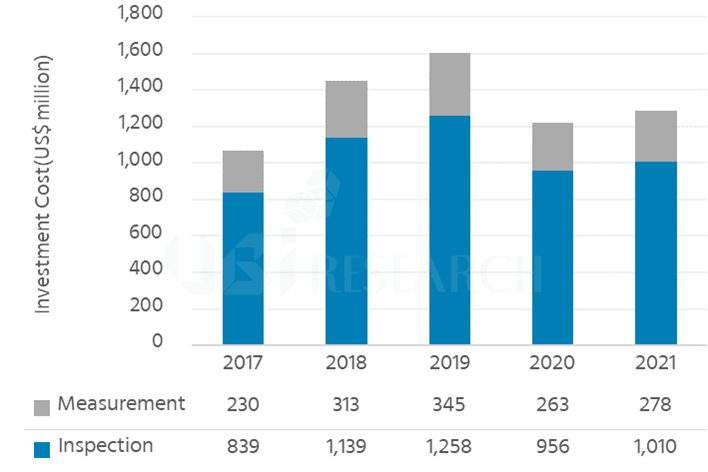

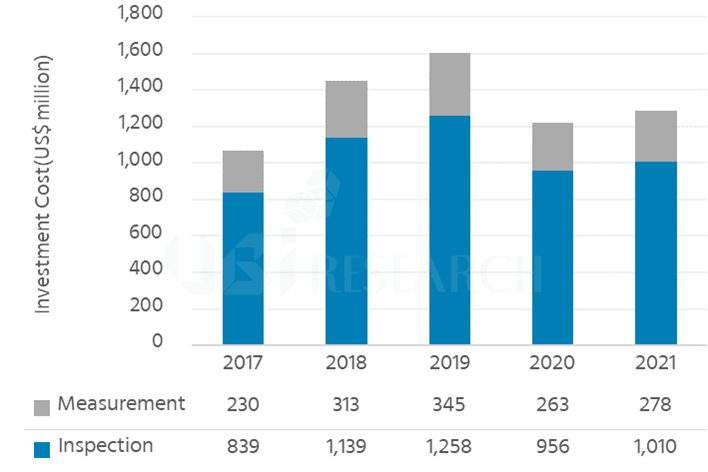

Inspection and measuring equipment market for OLED mobile device is expected to reach US$6.63 billion from 2017 to 2021

/in 미분류 /by OLEDNETAs the panel problem of mobile devices has become a hassle for consumers, each panel maker is strengthening the relevant inspection and measurement activities.

Inspection and measurement can contribute not only to enhance the quality and performance of products but also to enhance the brand image through customer satisfaction. In addition, it is expected that productivity and yield can be improved by stabilizing the process since it is possible to check the normal state of products at each process in real time.

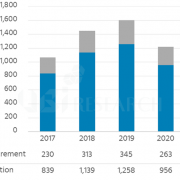

According to the ‘2017 Inspection and Measuring Equipment Report for OLED Mobile Device’ published by UBI Research, the inspection & measuring equipment market will reach a total of US$ 6.63 billion (about Korean Won 7.3 trillion) in the entire OLED equipment market from 2017 to 2021. In 2018, the investment for OLED inspection & measuring equipment is expected to be about US$ 1.45 billion (about KRW 1.6 trillion), with projected investment of US$ 1.6 billion (about KRW 1.8 trillion).

Choong Hoon Yi president of UBi Research announced that Samsung Display is currently in process of investment in A5 Gen6 flexible OLED line. LG Display is also reported to make a large-scale investment to raise OLED sales portion and Chinese OLED panel makers such as BOE and CSOT are making an active investment in OLED line. Hence, expectantly there will be constant market demand for inspection and measuring equipment.

In the report, the inspection and measuring equipment market from 2017 to 2021 is classified from various viewpoints. According to this report, the equipment used for substrate and TFT process will account for the biggest market share of 50.6% of the total inspection and measuring equipment market from 2017 to 2021. Market share of cell inspection equipment is projected as 29.7%, OLED pixel as 12.7%, and encapsulation as 7%, respectively. In the equipment market classified by test items, the equipment used for pattern inspection will account for 33.1% of the total market. Market share of repair equipment is projected as 21.3%, and light on/off inspection equipment as 16.4%, respectively.

Lastly, AOI equipment and laser repair equipment, the important piece of inspection and measuring equipment, are expected to reach US$ 2.33 billion and US$ 1.41 billion, respectively, from 2017 to 2021.

<Market forecast of inspection & measuring equipment for OLED mobile device from 2017 to 2021>

2017년부터 2021년까지 OLED Mobile 기기용 검사 · 측정장비 시장 66.3억 달러 기대

/in 미분류 /by OLEDNETMobile 기기의 panel 문제로 인해 소비자들의 불편이 가중되면서, 최근 각 panel 업체들은 검사 · 측정을 강화하고 있다.

검사 · 측정은 제품의 품질과 성능 향상뿐만 아니라 고객 만족을 통한 브랜드 이미지 제고에 기여할 수 있다. 또한, 각 공정에서 제품의 정상 유무를 실시간으로 점검할 수 있어 공정 안정화를 통한 생산성, 수율 향상이 가능할 것으로 예상된다.

유비산업리서치가 발간한 ‘2017 Inspection and Measuring Equipment Report for OLED Mobile Device’에 따르면, OLED 전체 장비 시장 중 검사 · 측정장비 시장은 2017년부터 2021년까지 총 66.3억 달러(약 7.3조원) 규모가 될 것으로 전망하고 있다. 2018년에는 14.5억 달러(약 1.6조원)의 OLED 검사 · 측정장비 투자가 진행 될 것으로 예상하고 있으며, 2019년에는 16억 달러(약 1.8조원)의 가장 많은 투자가 진행 될 것으로 전망하고 있다.

이충훈 대표이사는 Samsung Display는 A5 Gen6 flexible OLED line 투자를 진행중이며 LG Display는 OLED 매출 비중을 끌어올리기 위한 대규모 투자 내용 발표, BOE와 CSOT 등 중국의 OLED panel 업체들도 OLED 라인 투자를 적극적으로 진행하고 있기에 검사 · 측정장비는 지속적으로 수요가 있을 것으로 예상하고 있다.

본 보고서에서는 2017년부터 2021년까지의 검사 · 측정장비 시장을 다양한 관점에서 분류하여 전망하였다. 본 보고서에 따르면, 기판과 TFT에 사용되는 장비는 2017년부터 2021년까지 50.6%로 가장 큰 시장 점유율을 보이고 Cell은 29.7%, OLED 화소는 12.7%, encapsulation은 7% 순으로 전망하였다. 검사 · 측정 항목으로 분류한 장비 시장은 패턴검사가 33.1%, repair 21.3%, 점등 16.4% 순으로 나타났다.

마지막으로 검사 · 측정장비의 핵심 장비인 AOI 장비와 laser repair 장비는 2017년부터 2021년까지 각각 23.3억 달러와 14.1억 달러의 시장을 형성할 것으로 전망하고 있다.

<2017~2021년 OLED mobile 기기용 검사 · 측정장비 시장 전망>

UBI Research , Published the Market Report on OLED Manufacturing Equipment

/in Focus on, Market /by OLEDNET■The OLED equipmentmarket is expected to reach $84.9 billion in 5 years.

■Korean and Chinese panel companies will take over 90% of investment in panel equipment.

According to ‘2017 OLED Manufacturing Equipment Annual Report’ published by UBI Research, the entire equipment market of OLED is expected to total$84.9 billion(about 93trillion KRW) from 2017 to 2021. In 2017, $16.4 billion(about 18 trillion KRW) will be invested in OLED equipment.

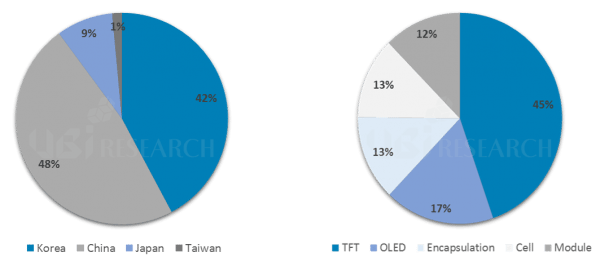

The OLED equipment for the market analysis is largely categorized by process into 5 kinds of equipment; TFT, OLED, encapsulation, cell, and module. The investment costs including distribution equipment and test equipment of each process are calculated, and touch-related equipment is excluded from the market analysis.

Hyun Jun Jang, a senior researcher of UBI Research forecasts that the two countries will lead the OLED market due to the massive investment from both Korean panel companies occupying the OLED industry and latecomers Chinese panel companies.

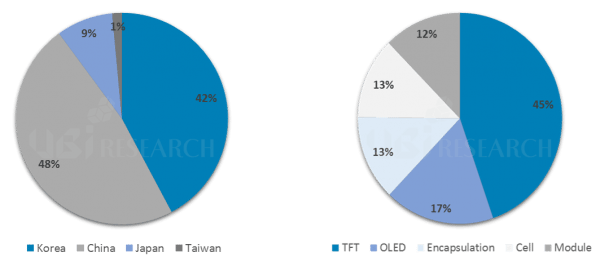

According to this report, China and Korea will actively invest in OLED equipment from 2017 to 2017, showinga 48% and a 42% OLED market share, respectively. In particular, the two countries are expected to make the largest investment of $32.8 billion(about 36 trillion KRW) in 2017 and 2018.

Samsung Display has been expanding small and medium OLED lines to be applied to Galaxy series and Apple, and LG Display has been investing in both small & medium and large-size OLED lines. China’s BOE and CSOT are likely to invest heavily in OLED line because especially BOE has decided to invest more than 30K in small and medium OLED lines every year since 2017.

<left) OLED Equipment Market Share by Process, right) OLED Equipment Market Share by Country>

From 2017 to 2021, itis forecast that TFT equipment, OLED pixel patterning equipment, encapsulation equipment, cell equipment, and module equipment will have a 45%, 17%,13%,13%, and 12% market share, respectively. In near future, the demand for flexible OLED will be likely to increase so that cell and module equipment will gain more importance having a 25% market share.

유비리서치, OLED 제조용 장비 시장 보고서 발간

/in 미분류 /by OLEDNET

유비리서치 유비리서치 유비리서치

■ 향후 5년간 OLED 전체 장비 시장 849억 달러 전망

■ 한국과 중국 panel 업체의 장비 투자 점유율 90%

유비리서치에서 발간한 ‘2017 OLED Manufacturing Equipment Annual Report’에 따르면 OLED 전체 장비 시장은 2017년부터 2021년까지 총 849억 달러(약 93조원) 규모가 될 것으로 전망하였다. 2017년에는 164억 달러(약 18조원)의 OLED장비 투자가 진행된다.

OLED 장비 시장 분석을 위한 장비 분류는 공정별로 크게 TFT, OLED, encapsulation, cell, module 총 5가지로 장비를 분류하였다. 각 공정별 물류 장비와 검사 장비를 포함한 투자 비용을 산출하였으며, touch관련 장비는 시장 분석에서 제외하였다.

유비리서치 장현준 선임연구원은 OLED 산업을 주도하고 있는 한국 panel업체들의 지속적인 투자와 후발 주자인 중국 panel업체들의 과감한 투자로 한국과 중국이 OLED 장비 시장을 주도할 것으로 예상하고 있다.

본 보고서에서 국가별 OLED 장비 시장은 2017년부터 2021년까지 중국이 48%, 한국이 42%의 점유율을 보이며 두 국가가 OLED 장비 투자를 주도할 것으로 분석됐다. 2017년과 2018년에 한국과 중국은 328억 달러(약 36조원) 규모로 가장 많은 투자를 할 것으로 전망하였다.

삼성디스플레이는 갤럭시 시리즈와 애플에 적용될 중소형 OLED 라인 투자를 확대하고, LG디스플레이는 대면적 OLED 라인과 중소형 OLED라인을 동시에 투자하고 있다. 중국에서는 BOE와 CSOT가 OLED 라인 투자를 적극적으로 진행할 것으로 보이며, 특히 BOE는 2017년부터 중소형 OLED 라인에 매년 30K 이상을 투자하기 때문이다.

<좌) 국가별 OLED 장비 시장 점유율, 우) 공정별 OLED 장비 시장 점유율>

2017년부터 2021년까지 TFT 장비 45%, OLED 화소 형성 장비 17%, encapsulation 장비 13%, cell 장비 13%, module 장비 12% 순으로 시장 점유율을 차지할 것으로 전망하였다. 향후 flexible OLED 수요가 크게 증가할 것으로 보이면서 cell 장비와 module 장비의 시장 점유율은 25%로서 중요도가 높아질 것으로 분석된다.

CITE 2017을 수놓은 OLED display

/in 미분류 /by OLEDNETCITE 2017

지난 4월 9일부터 11일까지 광둥성 선전에서 CITE(China Information Technology Expo, 중국 전자 정보 기술 박람회) 2017이 열렸다. 올해로 5회째를 맞는 CITE 2017은 중국 공신부와 선전시 정부가 주최하는 아시아 최대 전자 정보 전시회로 매년 1,600여 개 업체가 참여하고, 16만여 명이 참관하는 세계적인 IT 행사다.

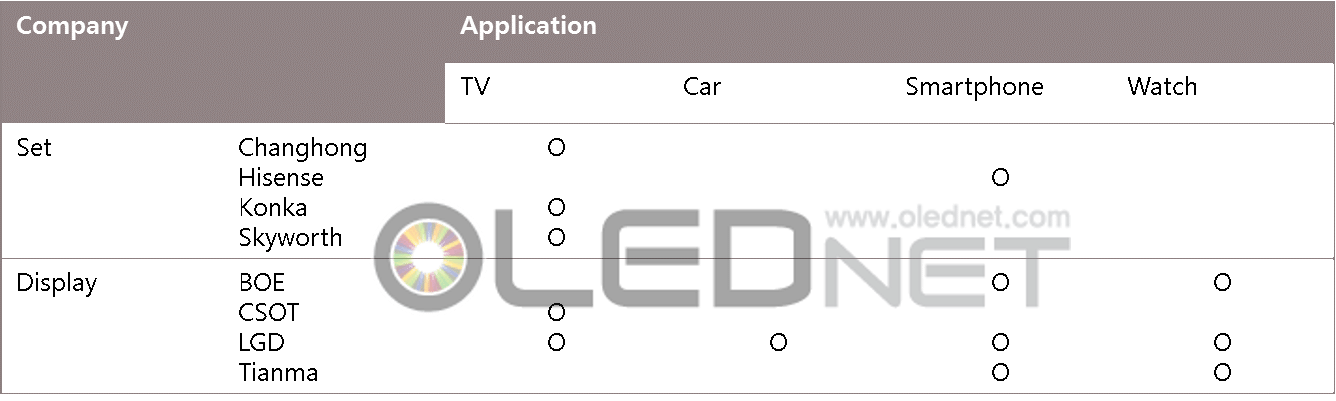

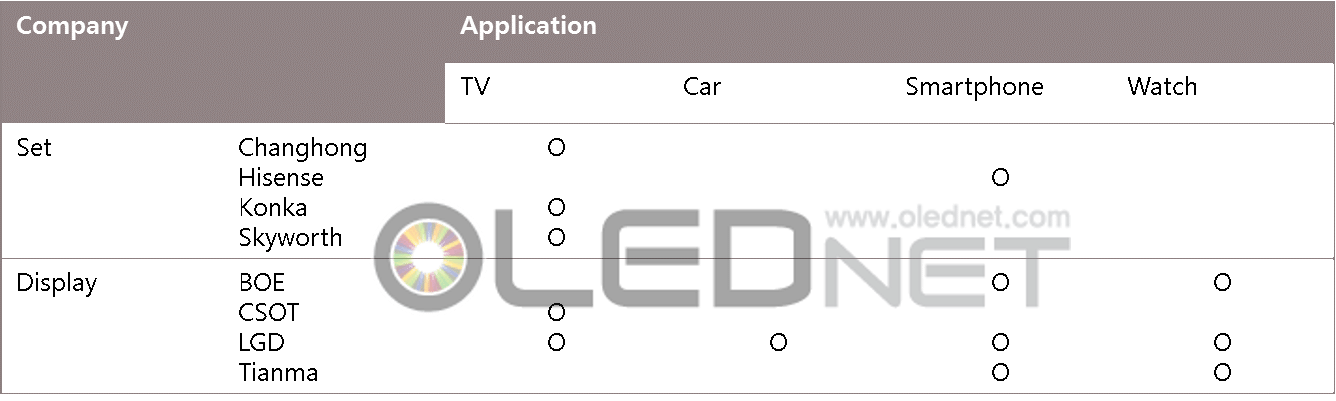

이 행사에서 LG Display와 BOE, CSOT, Tianma는 OLED 패널을 전시하였으며, Changhong과 Hisense, Konka, Skyworth가 OLED를 응용한 제품들을 선보였다. 그 외에 중국 OLED 산업 연맹 이름으로 Jilin OLED를 포함한 다수의 업체들이 공동관을 운영하였다.

<CITE 2017에서 전시 된 업체별 OLED 제품>

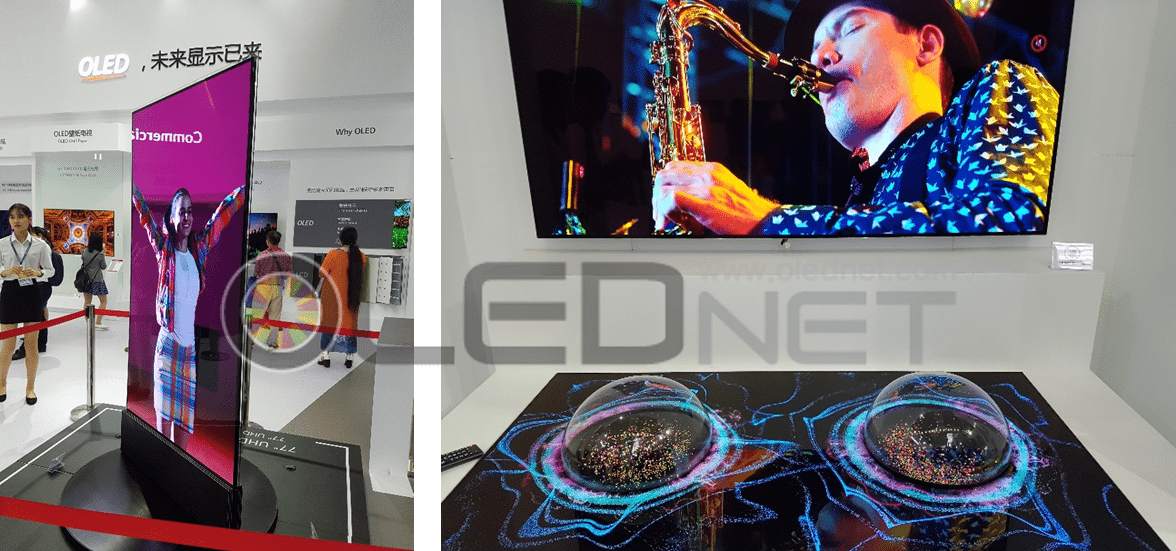

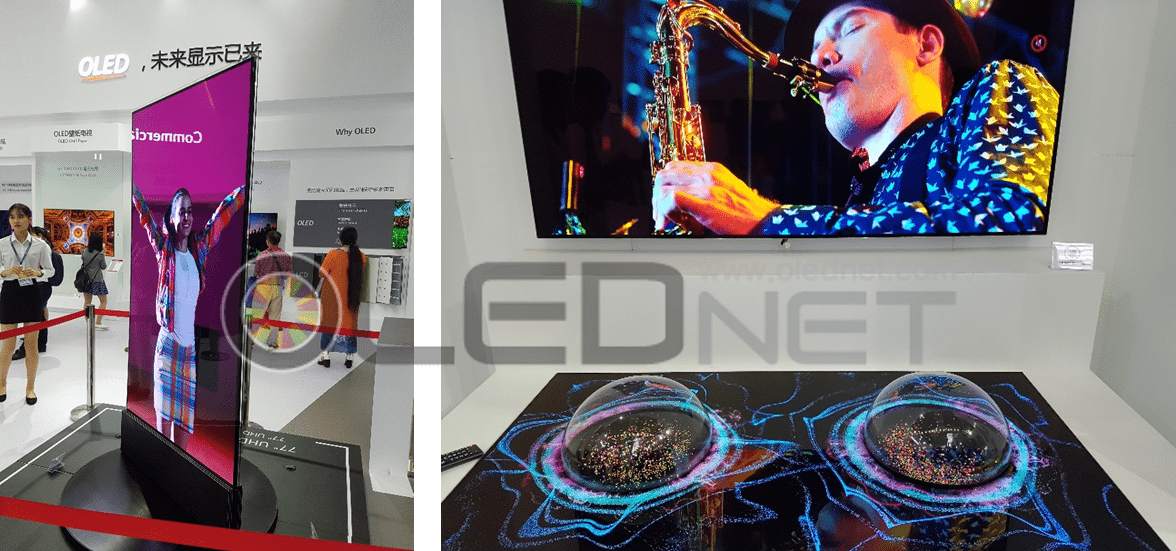

대면적 OLED 패널을 유일하게 양산하는 LG Display는 두께 3mm, 무게 7Kg의 초박형 초경량 디자인의 65인치 UHD Wall Paper OLED와 디스플레이 자체를 스피커로 구현하는 Crystal Sound OLED를 핵심 제품으로 전시하였다. LG Display는 Wallpaper TV용 OLED 패널로 기술력을 인정 받아 CITE 2017 기술혁신 금상을 시상 받았다.

<LG Display의 Wall paper OLED(왼쪽)와 Crystal Sound OLED(오른쪽)>

이 밖에도 LG Display는 77인치 UHD OLED 패널 6장으로 구성 된 기둥형태의 OLED Pillar와 77인치 UHD OLED 패널 2장을 붙인 Dual-view flat를 전시하는 등 OLED를 활용한 다양한 제품들을 선보였으며, 12.3인치 자동차용 curved OLED와 smartphone용 2종류, watch용 2종류 plastic OLED를 전시하였다.

<LG Display의 OLED pillar>

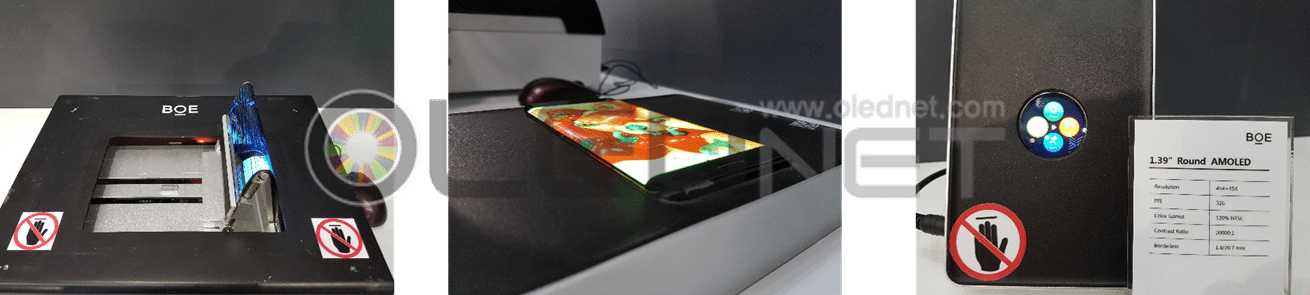

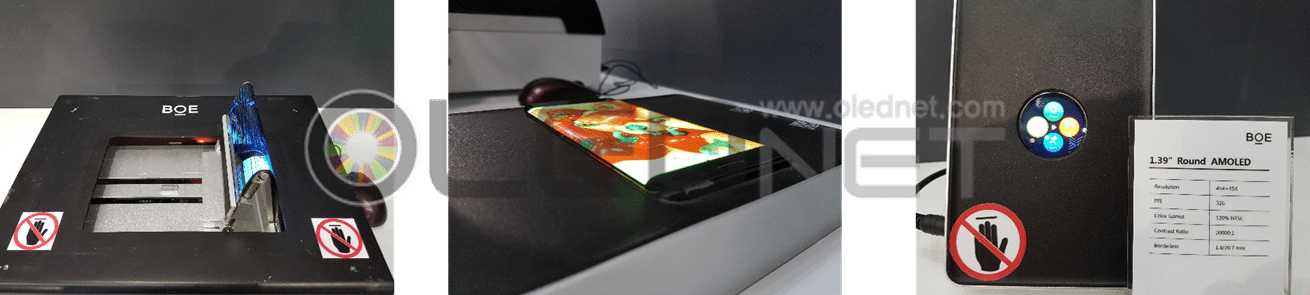

중국 OLED 패널 업체인 BOE는 7.9인치 foldable OLED와 5.5인치 edge bended OLED, 1.39인치 rounded OLED를 선보이며 기술력을 과시했다.

<BOE의 foldable OLED(왼쪽)와 edge bended OLED(가운데), round OLED(오른쪽)>

이 밖에 OLED TV를 전시한 세트업체는 Changhong과 Hisense, Skyworth로 모두 중국 업체들이며, 프리미엄 TV의 핵심 크기인 65인치 OLED TV를 주력으로 전시하였다. Hisense는 OLED TV 외에도 스마트폰 양면에 OLED 패널과 e-ink 패널을 같이 채택한 제품을 전시하였다.

<Changhong(왼쪽)과 Hisense(가운데), Skyworth(오른쪽)의 OLED TV>

OLED Display Embellished CITE 2017

/in Exhibition /by OLEDNETCITE 2017(China Information Technology Expo) was held in Shenzhen, China from April 9 to 11. As the Asia’s largest electronic and information exhibition hosted by the ministry of industry and information technology of the people’s republic of China and the local government of Shenzhen, the 5th CITE 2017 is the international IT event in which 1,600 companies participate annually, with 160,000 visitors.

At this expo, LG Display, BOE, CSOT, and Tianma exhibited OLED panel on one hand, and Changhong, Hisense, Konka, and Skyworth unveiled OLED-applied products on the other hand. Besides, many companies including Jilin OLED operated a shared exhibition hall under the name of China OLED Industry Alliance(COIA).

<Different Companies’ OLED Products at CITE 2017>

LG Display, the only large-area OLED panel manufacture unveiled its flagship 65-inch UHD Wall Paper OLED with an ultrathin and ultralight design of 3mm thickness and 7Kg weight, and Crystal Sound OLED displaying itself as a speaker. LG has received CES 2017 Innovation Award for its technology of Wallpaper TV OLED panel.

<LG Display’s Wall paper OLED(Left) & Crystal Sound OLED(Right)>

Besides, LG Display showcased various products applying OLED including OLED Pillar with six 77-inch UHD OLED panels and Dual-view flat with two 77-inich UHD OLED panels, while unveiling a 12.3-inch curved OLED for automobiles, two kinds of smartphones, and two kinds of plastic OLEDs for watches.

<LG Display’s OLED Pillar>

A Chinese OLED panel company, BOE boasted of its technology, demonstrating a 7.9-inch foldable OLED, a 5.5-inch edge bended OLED, and a 1.39-inch rounded OLED.

<BOE’s Foldable OLED(Left), Edge Bended OLED(Middle), Round OLED(Right)>

The other OLED TV set companies are all Chinese companies such as Changhong, Hisense, and Skyworth. They exhibited its flagship 65-inch OLED TV, a key size of premium TVs. Hisense exhibited the smartphone with OLED panel and e-ink panel on its both sides as well as OLED TV.

<Changhong(Left), Hisense(Middle), Skyworth’s OLED TV(Right)>

[Finetech Japan 2017] 차세대 대면적 display는 Ink-jet printing OLED

/in 미분류 /by OLEDNETInk-jet printing OLED 가 차세대 대면적 디스플레이로 다시 한 번 주목 받고 있다.

5일부터 도쿄 빅사이트에서 열린 Finetech Japan 2017의 keynote session에서 중국의 CSOT에서는 차세대 대면적 display는 Ink-jet printing이 될 것으로 예상했다. CSOT의 CTO York Zhao씨는 신제품 가격이 기존제품 가격의 1.2~1.3배정도가 됐을 때가 신제품이 기존제품을 본격적으로 대체할 수 있는 타이밍이라며, LCD가 기존의 CRT, PDP 시장을 대체할 때에도 이법칙은 그대로 적용되었다.” 라고 언급하였다.

그리고 “대면적 OLED의 가격도 LCD 대비 1.2~1.3배로 떨어져야 본격적인 OLED 시대가 열릴 것이며 대면적 OLED의 가격하락을 위해서는 Ink-jet printing 기술이 최적이다.” 라고 발표하였다.

<Finetech Japan 2017에서 keynote를 강연중인 CSOT의 CTO, York Zhao>

CSOT는 2016년 Tianma와 함께 printing display alliance인 “Guangdong Juhua printing display technology”를 설립하였으며, kateeva와 DuPont, ULVAC, Merck, Jusung Engineering 등이 참여하고 있다.

CSOT의 발표에 이어서 JOLED 에서는 직접 Ink-jet printing을 적용하여 제작한 다양한 OLED panel 들을 소개하였다. 가장 관심을 끌었 던 것은 이시카와의 Gen4.5 라인에서 제작한 Ink-jet printing 21.6 inch 4K(3840 x 2160, 204 ppi) AMOLED panel 이었다. JOLED의 CTO Yoneharu Takubo 씨는 “JOLED 설립 이후로 ppi를 향상시키는 방향으로 개발을 진행해왔으며, 204 ppi의 해상도까지 안정적으로 제작할 수 있는 기술을 확보하였다.

현재 350 ppi를 목표로 개발 중이며, 중소형에서 대면적까지 제품군을 확대하여 Ink-jet printing AMOLED로 다양한 application을 확보할 것” 이라고 밝혔다.

<Finetech Japan 2017에서 keynote를 강연중인 JOLED의 CTO, Yoneharu Takubo>

Ink-jet printing 공정은 Gen8 이상의 양산라인에서 RGB 구조의 AMOLED panel을 원장 분할없이 제조할 수 있어 주요 panel 업체에서 지속적으로 개발 중에 있는 기술이다. 또한 재료사용효율이 이론상 100%에 가까워 OLED의 원가를 절감할 수 있다는 장점도 있다.

반면에 양산이 아직 검증되지 않았다는 점과 soluble 발광재료의 효율과 수명이 증착 재료 대비 낮다는 이슈가 있어 주요 발광재료, 장비, 패널업체에서 적극적인 개발이 이루어 지고 있는 상황이다.

이처럼 Ink-jet printing OLED가 차세대 디스플레이 기술로 주목 받고 있으며, 어느 시점에 상용화가 될 수 있을지 업계의 관심이 집중되고 있다.

Ink-jet printing OLED, Next-generation large-area display

/in Market, Technology /by OLEDNETInk-jet printing OLED is attracting public attention once again as a next-generation large-area display.

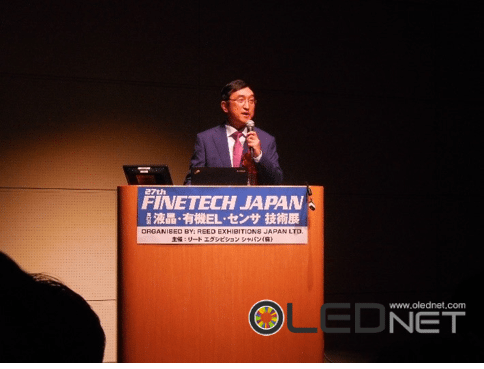

At the keynote session of Finetech Japan 2017 held at Tokyo Big Sight as from May 5, CSOT in China prospected that next-generation large-area display would be ink-jet printing. York Zhao, the CTO of CSOT said that when the price of a new product is 1.2 to 1.3 times that of an existing product, it is the right time for the existing product to be replaced with new one. This principle has been applied when the CRT and PDP market was replaced by LCD. He added, “The price of large-area OLEDs should drop 1.2 to 1.3 times lower than LCDs to lead to a full-fledged OLED era, and ink-jet printing technology is the best way to assist the drop in price of OLED.”

<CSOT, York Zhao CTO>

In 2016, CSOT established the printing display alliance called “Guangdong Juhua printing display technology” together with Tianma, and has been participated by kateeva, DuPont, ULVAC, Merck and Jusung Engeering.

Following the announcement of CSOT, JOLED introduced various OLED panels in direct application of ink-jet printing. One of the most interesting devices was the ink-jet printing 21.6 inch 4K (3840 x 2160, 204 ppi) AMOLED panel produced in Gen 4.5 line. Yoneharu Takubo, the CTO of JDI said, “Since the establishment of JOLED, we have been improving ppi, and developed a technology to stably produce up to 204 ppi resolution. We are targeting 350 ppi and expand its product range from small and medium to large area to secure a variety of applications with ink-jet printing AMOLED. ”

<JOLED, Yoneharu Takubo CTO>

Ink-jet printing process is a technology under continuous development of major panel makers as AMOLED panel of RGB structure can be manufactured without dividing the ledger in the mass production line higher than Gen8. Also, material utilization efficiency is theoretically close to 100% to save the OLED unit cost. However, some issues arise that mass production has yet to be fully verified, and the efficiency and life span of soluble light emitting materials are inferior to those of deposition materials; hence, there has been undergoing active development in the manufacturers of light emitting materials, equipment and panels.

Ink-jet printing OLED becomes the center of public attention as a next-generation display technology, and when it will be commercialized is a matter of a question.

Solution Process OLED 도입 예상효과는?

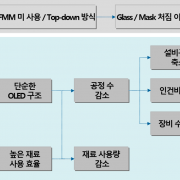

/in 미분류 /by OLEDNETSolution process OLED는 발광층 재료들을 solvent에 녹인 후 용액화 하여 printing으로 형성한 OLED이다. 일본의 JOLED와 LG Display에서 가장 적극적으로 개발하고 있으며, 중국의 BOE와 CSOT에서도 개발을 진행중이다.

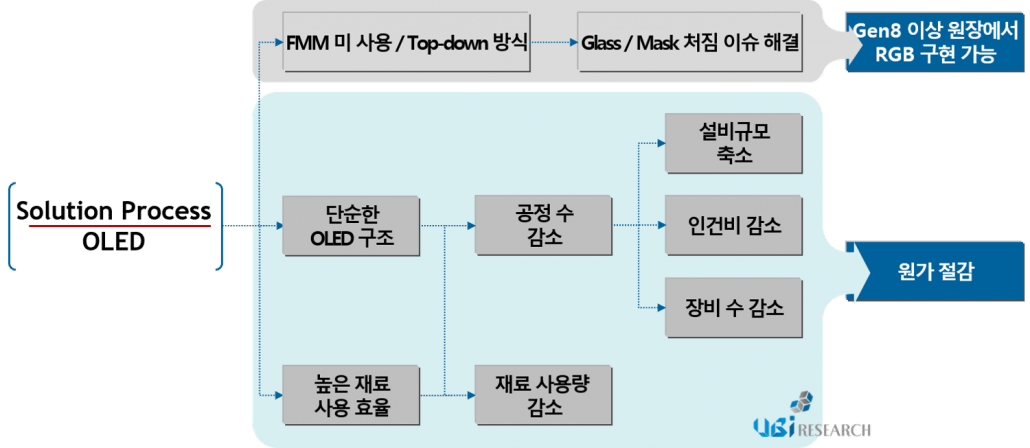

Solution process는 Gen8이상 원장에서 RGB pixel 구조의 대면적 OLED panel 구현이 가능하고, 재료사용효율이 높고 단순한 layer로 개발되고 있어 양산 성공 시 원가절감이 가능하다는 장점이 있다.

Solution Process OLED 도입 시 기대 효과, “Market Entry Analysis for Solution Process OLED -The Possibilities and Opportunities Report”, UBI Research

하지만 soluble OLED 발광 재료의 효율과 수명이 증착재료 대비 낮다는 점과, OLED 구조와 재료가격이 정해지지 않은 점 등등의 다양한 이슈들이 존재하고 있다.

현재 대면적 OLED 시장은 WRGB 방식으로 프리미엄시장 공략의 전략을 펼치고 있지만 추후 LCD를 OLED로 대체하기 위해서는 저비용/고생산 기술이 핵심 요소이며, solution process OLED가 핵심기술이 될 것으로 예상된다.

대면적 OLED가 프리미엄 TV 시장에서 멈출지, 프리미엄 TV 시장에서 벗어나 중저가 TV시장까지 진출하여 LCD와 경쟁을 할지는 solution process OLED의 성공여부에 결정될 것으로 예상된다.

BOE and CSOT, Acquired the China first title through the panel for OLED TV

/in Focus on, Set /by OLEDNETIn ‘18th China High- Tech Fair,’ BOE collected a big topic by exhibiting 55” UHD OLED TV of Skyworth to which 55” UHD OLED Module was applied.

CSOT also publicized 31inch curved FHD OLED panel this time even though they have exhibited 31inch FHD OLED panel in the past.

About 80inch was realized by attaching 3 Curved OLED panels, and resolution was 5760*1080 along with 150nits brightness.

Two enterprises manufactured the product together by applying WRGB+CF structure having been produced massively in LG Display.

In this exhibition, BOE and CSOT became to have first tile in Chinese enterprises with 55inch UHD OLED and 31inch curved OLED, and it is expected that it could be new drive of WRGB OLED panel market afterwards.

BOE and CSOT are manufacturing the panel for OLED TV in Gen8 pilot line of Hefei and Gen4.5 R&D line of Shenzhen, China respectively, and two enterprises are under positive consideration about large-scale OLED mass production lines.

Currently LG Display possesses mass production lines uniquely in relation with large-scale OLED panel market, and is leading OLED panel market alone. In future, BOE and CSOT are expected to join in large-size OLED panel market, and it is anticipated that market expansion through competitions in large-size OLEF panel market could be made.

BOE와 CSOT, OLED TV용 panel에서 중국 최초 타이틀 획득

/in 미분류 /by OLEDNET지난 16일에 개최된 ‘제 18회 중국 하이테크페어’에서 BOE는 55inch UHD OLED Module이 적용된 Skyworth의 55inch UHD OLED TV를 전시하여 큰 화제를 모았다.

BOE의 55inch UHD OLED Module과 55inch UHD OLED TV

CSOT도 기존에는 31inch FHD OLED panel을 전시했지만 이번엔 31inch curved FHD OLED panel을 공개하였다.

Curved OLED panel 3장을 붙여 약 80inch를 구현하였으며, 해상도는 5760*1080, 휘도는 150nits이다.

두 업체 모두 LG Display에서 양산중인 WRGB+CF 구조를 적용하여 제조하였다.

CSOT의 31inch curved FHD OLED panel 3장

이번 전시를 통해 BOE와 CSOT가 각각 55inch UHD OLED와 31inch curved OLED로 중국업체 최초타이틀을 가지게 되었으며, 앞으로 WRGB OLED panel 시장 성장에 새로운 원동력이 될 수 있을 것으로 기대된다.

BOE는 Hefei의 Gen8 파일럿 라인에서 CSOT는 중국 Shenzhen의 Gen4.5 R&D 라인에서 OLED TV용 panel을 제조하고 있으며, 두 업체 모두 대면적 OLED 양산라인에 대한 투자를 적극적으로 검토 중에 있다.

현재 대면적 OLED panel 시장은 LG Display가 유일하게 양산라인을 보유하고 있으며 단독으로OLED panel 시장을 이끌어가고 있다. 앞으로 BOE와 CSOT가 대면적 OLED panel 시장에 가세할 것으로 예상되며, 대면적 OLED panel 시장에서 경쟁을 통한 시장확대가 이루어 질 것으로 기대된다.

“CSOT Invests 7,740 Million USD in Gen11 LCD Line Construction”

/in 미분류 /by OLEDNET

TCL Corporation Which Includes CSOT(Source=TCL)

Hyunjoo Kang / Reporter / jjoo@olednet.com

Chinese media reported that CSOT (China Star Optoelectronics Technology) is planning to invest $ 7,740 million in constructing Gen11 TFT-LCD panel mass production line.

According to the Chinese media, this company is planning to establish the Gen11 LCD mass production line in factory located in Shenzhen, south of China. The line is for 45 inch and 66 inch large area panel for TV. This mass production that CSOT is newly building is known to produce 3000mm x 3000mm or larger using glass substrate, and cut in 18 different sizes with the highest cutting efficiency of 97%.

Of Chinese panel production companies, CSOT has the second highest market share after BOE. At present, CSOT is operating Gen8.5 mass production line for large area panel and Gen6 LTPS line for small to medium-sized panel in Wuhan area in China. It also intends to establish another small to medium sized OLED panel mass production line for smartphone and tablet in Wuhan this year.

Higher the Generation of the line, it is more advantageous for large area panel production. If BOE completes Gen10.5 line construction, and CSOT Gen11 line, this means China is equipped with superior price competitiveness within large area LCD panel sector such as 60 inch panel for TV. Accordingly, the trend of LCD panel market leadership transference from Korea to China looks to be accelerated.

In fact, Korean key display companies, including Samsung Display and LG Display, only possess, at maximum Gen8 mass production line manufacturing equipment. Many display experts estimate that due to the supply of LCD pouring out from China, Korean display companies will record deficit in Q1 2016.

“CSOT 11세대 LCD 라인 구축에 9조원 투자”

/in 미분류 /by OLEDNET

CSOT가 속한 TCL 그룹(출처=TCL)

강현주 기자 / jjoo@olednet.com

CSOT(China Star Optoelectronics Technology)가 11세대 TFT-LCD 패널 양산라인 구축에 77억4천만달러(한화 약 8조9천억원)를 투자할 계획이라고 중국 언론들이 보도했다.

중국 언론들의 보도에 따르면 CSOT는 중국 남부 선전에 위치한 공장에 11세대 LCD 양산 라인을 구축할 계획이다. 이 라인은 45인치 및 66인치 TV용 대형패널 생산용이다.

CSOT가 신규 규축하게 될 이 양산라인은 유리 기판(glass substrate)을 이용해 3000mm x 3000mm 이상의 패널을 생산하고 18개의 다른 크기로 절단되며 최대 면취율(cutting efficiency)은 97%인 것으로 알려졌다.

CSOT는 중국 패널 생산업체들 중 시장점유율이 BOE에 이어 2위다. CSOT는 현재 대형 패널 생산을 위한 8.5세대 양산라인과 중소형 패널용 6세대 LTPS 라인을 중국 우한 지역에 운영하고 있다.

CSOT는 이 외에도 올해 우한에 스마트폰 및 태블릿을 위한 중소형 OLED 패널용 또 다른 양산라인을 구축할 계획이다.

최근 BOE도 중국 허페이에 10.5세대 LCD 생산라인 구축에 약 7조원 규모의 투자를 시작했다고 국내외 언론들이 보도했다.

세대가 클수록 대형 패널 제작에 유리하다. BOE가 10.5세대 라인 구축을, CSOT가 11세대 라인 구축을 완료하게 되면 TV용 60인치 패널 등 대형 LCD 패널 부문에서 월등한 가격경쟁력을 갖추게 된다는 얘기다.

이에 대형 LCD 패널 시장의 패권이 한국에서 중국으로 넘어가는 추세가 가속화 될 것으로 보인다.

실제로 삼성디스플레이, LG디스플레이 등 한국의 주요 디스플레이 업체들은 현재 최대 8세대 양산라인 장비까지만 보유한 상황이다. 한국 디스플레이 업체들은 중국으로부터 쏟아지는 LCD 물량공세에 2016년 1분기 적자를 기록할 것이란 예상이 우세한 상황이다.

Foxconn’s Large Size Panel Yield, Equal to Samsung·LG within 2016

/in Market /by OLEDNET

Foxconn is expected to occupy approximately 22% of 2016 Q4 global large size panel yield(Source : Foxconn)

Hyunjoo Kang / Reporter / jjoo@olednet.com

Foxconn is expected to occupy approximately 22% of 2016 Q4 global large size panel yield, similar to the levels of Samsung Display and LG Display.

Foxconn, recently confirmed to buy 66% of Sharp’s stake for $ 3.5 billion, is estimated to actively invest in improving Sharp’s panel competitiveness against Samsung Display and LG Display.

DigiTimes recently reported their research indicates Sharp’s large size panel yield will occupy 5.3% of global market in Q4 2016. This places the company on the 7th place after Samsung Display, LG Display, Innolux, AUO, BOE, and CSOT.

However, Sharp and Innolux are under Hon Hai Precision (Foxconn Technology). If the Q4 2016 large size panel yield of Sharp and Innolux are combined, the global occupancy is added to 21.9%. This is approximately the same level as Samsung Display (23.7%) and LG Display (22.7%).

Foxconn is analyzed to be investing in Sharp mainly with focus on OLED. According to a recent DigiTimes article, Foxconn is planning to invest approximately US$ 1.8 billion in OLED development.

DigiTimes estimates that Foxconn will actively begin mass production of OLED for smartphone from 2018, and expand the production to large and medium-sized OLED panel for TV, notebook, etc. Foxconn is forecast to begin shipment of OLED for TV from 2021, and annually ship 7,200,000 units of OLED panel for TV in 2025.

“폭스콘 대형 패널 생산량, 올해 삼성·LG와 맞먹는다”

/in 미분류 /by OLEDNET

출처=Foxconn

강현주 기자 / jjoo@olednet.com

폭스콘(Foxconn)이 오는 2016년 4분기 전세계 대형 패널 생산량의 약 22%를 차지, 삼성디스플레이와 LG디스플레이와 거의 비슷한 수준이 될 것이라는 전망이 제기됐다.

최근 샤프 지분의 66%를 약 4조원에 인수하기로 한 폭스콘은 앞으로 삼성디스플레이, LG디스플레이에 맞서 샤프의 패널 경쟁력을 향상시키는 데 적극적으로 투자할 것으로 예상된다.

디지타임즈의 최근 보도에 따르면 폭스콘은 앞으로 약 2조원을 OLED 개발에, 약 6천300억원을 TFD-LCD 개발에 투자할 계획이다.

이 매체는 자사 리서치 자료를 인용해 샤프의 대형 패널 생산량은 2016년 4분기 전세계 5.3%의 점유율을 차지할 것으로 전망했다. 이는 삼성디스플레이, LG디스플레이, 이노룩스, AUO, BOE, CSOT에 이어 7위다.

하지만 샤프와 이노룩스는 폭스콘그룹 하에 있다. 샤프와 이노룩스의 2016년 4분기 대형 패널 생산량을 합치면 전세계 21.9%의 점유율이 된다. 이는 삼성디스플레이(23.7%)와 LG디스플레이(22.7%)의 수치에 맞먹는 수준이다.

한편 Foxconn은 앞으로 주로 OLED에 초점을 두고 샤프에 투자할 것으로 보인다. 디지타임즈에 따르면 폭스콘은 오는 2018년부터 스마트폰용 OLED 양산을 본격적으로 시작하고 이후 TV, 노트북 등 대형 및 중형 OLED 패널 생산도 확대해 나갈 계획이다.

폭스콘은 오는 2021년부터 TV용 OLED 출하를 시작하고 2025년에는 연간 720만장의 TV용 OLED 패널을 출하할 것으로 전망된다.

Solution Process Panel, Cheaper To Produce than LCD

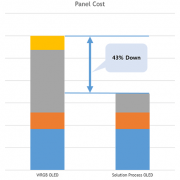

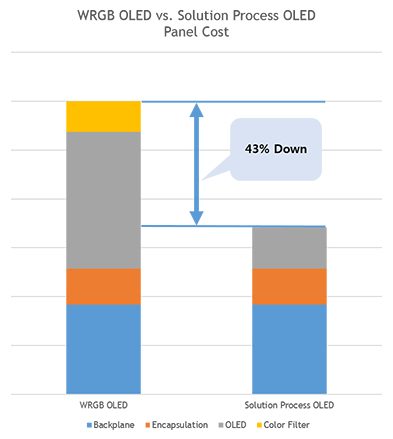

/in Display, Focus on /by OLEDNETAccording to 2015 Solution Process OLED Report, published by UBI Research on October 14, solution process technology could produce 55inch OLED panel at approximately 43% cheaper cost compared to WRGB method.

The report added that this value is the result of analysis of 2015 Q2 55inch UHD OLED panel price and yield, which is slightly higher than current production price of 55inch UHD LCD panel. However, considering that the solution process OLED structure will become simplified and that yield of backplane and encapsulation can be improved, the OLED panels will be able to be produced at lower cost than LCD panel. The report also revealed that solution process OLED can be an alternative solution for large area OLED panel in achieving price competitiveness.

Solution process is a technology that can produce large area RGB pixel OLED panel using Gen8, or higher, equipment without cutting the mother glass. Key AMOLED panel companies are active in developing this technology.

However, as solvent is used in order to turn the existing evaporation material into ink, its purity is decreased leading to lower emitting efficiency and therefore lower lifetime. Despite these factors, key panel companies’ enthusiasm for solution process technology is due to the high emitting material usage efficiency without using color filter, and simple structure compared to WRGB OLED panel which leads to production cost decrease.

Panasonic has been most active in developing solution process applied OLED panel, and has presented several times in CES and IFA. BOE and AUO also have revealed solution process OLED panel produced via ink-jet manufacturing equipment, and CSOT is considering solution process development. Samsung Display and LG Display, leaders of AMOLED industry, are also actively developing the technology. LG Display has adopted Gen8 ink-jet manufacturing equipment, and Samsung Display has started solution process OLED panel development with a focus on ink-jet manufacturing equipment companies.

Material and manufacturing equipment companies as well as panel companies are leading the solution process technology development and commercialization. Kateeva agreed on technology collaboration with Sumitomo Chem. while Merck did the same with Seiko Epson. DuPont recently revealed that they enlarged solution process OLED material production facilities and began operation.

Following these participation by key panel, material, and manufacturing equipment companies in solution process technology development and commercialization, it is anticipated that the solution process OLED panel market will record rapid growth.

UBI Research’s 2015 Solution Process OLED Report forecast that solution process OLED panel market will actively begin mass production from 2018 and show approximately US$ 2,329 million in 2020.

Solution process OLED panel, LCD보다 저렴하게 제작 가능

/in 미분류 /by OLEDNET유비산업리서치에서 14일 발간한 “2015 Solution Process OLED Report”에 따르면 “Solution process로 55inch OLED panel을 현재 양산되고 있는 WRGB 방식의 OLED panel보다 약 43% 저렴하게 제작할 수 있다.”라고 분석했다.

보고서에서는 “2015년도 2사분기 기준 55inch UHD OLED panel 가격과 수율을 기준으로 분석한 수치로서 현재 55inch UHD LCD panel의 제조 원가보다는 약간 높게 나타났다. 하지만 solution process OLED의 구조가 단순화 될 것이라는 점과 backplane과 encapsulation 수율이 개선될 수 있는 점을 고려해보면 LCD panel보다 저렴하게 제조할 수 있을 것”이라고 덧붙이며 solution process OLED가 대면적 OLED panel의 가격경쟁력을 확보할 수 있는 대안이 될 것이라고 밝혔다.

Solution process는 대면적 OLED panel을 Gen8 이상의 장비에서 원장 분할 없이 RGB pixel 구조로 제조할 수 있는 기술이며 주요 AMOLED panel 업체에서 적극적으로 개발을 진행 중에 있다.

하지만 solution process에 적용되는 발광재료는 기존 증착재료를 ink화를 시키기 위해 solvent를 섞기 때문에 증착재료보다 순도가 낮아 발광효율이 떨어지고 수명이 낮을 수 밖에 없다. 그럼에도 불구하고 solution process를 주요 panel 업체들에서 적극적으로 개발하고 있는 이유는 color filter를 사용하지 않고 발광재료 사용효율이 높으며 WRGB방식의 OLED panel에 비해 구조가 단순하기 때문에 원가절감을 할 수 있다는 점이다.

Solution process를 적용한 OLED panel은 Panasonic에서 가장 적극적으로 개발을 진행해왔으며 CES와 IFA에서 여러 차례 공개한 적이 있다. BOE와 AUO도 ink-jet 장비를 이용한 solution process OLED panel을 공개한 바 있으며 CSOT에서도 기술개발 방향을 solution process로 검토 중에 있다. AMOLED 산업의 선두주자인 Samsung Display와 LG Display에서도 적극적으로 개발을 진행 중이다. LG Display는 Gen8 ink-jet 장비를 도입하였으며 Samsung Display도 ink-jet 장비업체들을 중심으로 solution process OLED panel 개발에 본격적으로 착수한 상태이다.

Panel 업체뿐만 아니라 재료와 장비업체들도 solution process 기술개발과 상용화에 앞장서고 있다. Kateeva와 Sumitomo Chem., Merck와 Seiko Epson은 기술 협업을 맺었으며 DuPont는 soluble OLED 재료 생산시설 규모를 늘리고 가동을 시작했다고 최근 밝힌 바 있다.

이처럼 solution process 기술 개발과 상용화에 panel 업체뿐만 아니라 주요 재료, 장비업체들이 참여함에 따라 solution process OLED panel 시장은 빠른 시일 내에 성장할 것으로 기대된다.

“2015 Solution Process OLED Report”에서는 solution process OLED panel 시장이 2018년부터 본격적으로 양산되기 시작하여 2020년 약 US$ 2,329 million 규모로 성장할 것으로 전망했다.

Korea, China, and Japan’s OLED TV Alliance to Boost the Market

/in Market /by OLEDNETKorean companies had been leading the OLED TV industry. Before SID 2015 (31 May – 5 June), LG Display and Samsung Display had been the only companies to reveal 4K OLED panels, and until now, LG Electronics has been the only company to sell 4K OLED TV in large quantity. In terms of OLED TV market, despite OLED’s superior characteristics compared to LCD regarding contrast ratio, high viewing angle, fast response time, and thinness, the market share has been limited mostly due to its relative high price. However, this is expected to change soon.

LG Electronics has been pushing for OLED TV alliance and corporation with Chinese and Japanese companies. As a result, Chinese and Japanese companies resolved to jump into OLED TV market from the second half of 2015. Japan’s Panasonic and Sony are expected to release OLED TV for the first time later this year. China’s Skyworth, Changhong, Konka, and Hisense are expected begin sales from this fall.

Consequently, the number of set companies producing 4K OLED TVs will increase to 7 by the end of 2015. LG Display, the only company that can mass produce OLED panel with 4K resolution, is planning to increase production by 4 times this summer to supply these new to OLED TV set companies.

As mentioned above, until SID 2015, LG Display and Samsung Display had been the only companies which showed 4K OLED panels, and with LG Display being the sole company able to mass produce 4K OLED panels. However, in SID 2015, AUO showed their own 4K OLED panel during an author interview session, and CSOT and BOE presented paper on 4K resolution OLED panel. This signifies they possess technology needed for OLED panel production, and with proper investment they can begin mass production.

Soon LG Display will no longer be the lone supplier of OLED panels contributing toward increase in shipment of OLED panels and OLED TVs. This will naturally lead to lower cost for consumers and energize OLED TV market.

한국과, 중국, 일본의 OLED TV 동맹, OLED TV 시장 본격 개화

/in 미분류 /by OLEDNETOLED TV 산업은 지금까지 한국 기업들이 이끌어 왔다. 미국 산호세에서 열린 SID 2015 (5/31~6/5) 전까지는 LG디스플레이와 삼성디스플레이가 4K OLED 패널을 공개한 유일한 패널업체였고, 현재까지 OLED TV를 대량으로 판매하는 업체는 LG전자가 유일하다. 그 동안, TV 시장에서는 OLED가 LCD보다 명암비와, 시야각, 응답속도, 두께에 관하여 우월하나 비교적 높은 가격으로 인해 시장점유율이 제한되었다. 하지만, 이제 이는 곧 달라질 것으로 예상된다.

그 동안, LG전자는 OLED TV 동맹으로 중국, 일본 업체들과의 협력을 추진해 왔다. 그 결과 중국과 일본 업체들은 2015년 하반기부터 OLED TV 시장에 뛰어들기로 하였다. 일본의 파나소닉과 소니는 올해 하반기에 OLED TV를 처음으로 출시할 예정이며, 중국의 스카이워스와, 창훙, 콩카, 하이센스는 이번 가을부터 판매를 시작할 계획이다.

결과적으로 2015년 말까지 4K OLED TV를 생산하는 세트업체는 7개로 늘어난다. 4K 해상도의 OLED 패널을 대량 생산할 수 있는 유일한 업체인 LG디스플레이는 OLED TV 생산을 시작하는 세트업체들에 공급하기 위해 올 여름 생산량을 4배 증가시킬 예정이다.

위 언급한 내용과 같이, SID 2015까지 4K OLED 패널을 공개한 업체는 LG디스플레이와 삼성디스플레이가 유일했고, 이 두 업체 중 LG디스플레이만이 4K OLED 패널을 대량 생산 할 수 있다. OLED TV를 생산할 세트업체는 늘어나고 있지만 패널 공급업체는 LG디스플레이 한 곳으로서 장기적으로 봤을 때 추가적인 공급업체가 더 필요할 것으로 예상된다.

이번 SID 2015에서 AUO는 author interview 시간에 4K OLED 패널을 선보였고, CSOT와 BOE는 4K OLED 패널 관련 논문을 발표했다. 이는 AUO와 CSOT, BOE가 OLED 패널 제작에 필요한 기술을 보유하고 있다는 것을 나타내고 있으며, 적절한 시기에 투자가 이루어진다면 대량생산을 시작할 수 있다는 것을 의미한다.

따라서 앞으로 증가할 것으로 예상되는 OLED TV 수요에 맞춰 LG디스플레이뿐 아니라 후발 업체들 또한 OLED TV용 패널을 양산할 것으로 기대되어 OLED 패널과 OLED TV 출하량 증가에 기여할 것으로 전망된다. 이러한 발전은 소비자에게는 낮은 가격으로 연결될 것이고 OLED TV 시장은 활성화 될 것이다.

[SID 2015] Chinese LCD’s Continuous Evolution. OLED, What To Do?

/in Exhibition /by OLEDNETLCD technology of Chinese companies is continually evolving. In SID 2015, BOE exhibited world’s largest 110inch 8K and world’s first 82inch 10K LCD panels. CSOT drew much attention with its world’s largest 110inch UHD curved LCD TV. By exhibiting ultra high resolution and large size LCD panel ahead of Korean and Japanese panel companies, CSOT aptly demonstrated that Chinese companies have caught up to Korean and Japanese technology skills.

BOE presented NTSC 99% 27inch QHD LCD panel, and CSOT showed NTSC 118% 55inch UHD LCD panel. Particularly, CSOT exhibited 4mm thick 32inch FHD LCD TV and 5.5 mm thick 4K curved LCD panel; this showed that LCD is able to catch up to OLED’s thinness and color gamut advantages. Thus, with LCD’s continuous new technology development and price competitiveness, LCD and OLED’s leadership competition will once again heat up in next generation display’

The current large area TV market is led by LCD and OLED is slowly expanding the market starting with premium TV. Even in premium market, with price competitiveness LCD is one step ahead with QD film applied LCD TV. Therefore, the technology development of LCD that is catching up to OLED’s advantages is expected to be a hurdle for OLED’s market opening.

Although LCD’s color gamut, thickness, contrast ratio, and response time is being continually improved and can approach to OLED’s level but cannot be equal to OLED in all areas. For example, if the thickness is reduced in LCD, the QD film application needed for increased color gamut is difficult. Even if panel with many positive traits altogether is developed, it is expected to take much time giving OLED chance to drop the price to LCD level. Therefore, reducing OLED panel’s price by OLED’s active investment and yield achievement is analyzed to be an essential condition for next generation display leadership.

[SID 2015] 중국 LCD의 거침없는 발전, OLED 어떡하나?

/in 미분류 /by OLEDNET중국업체의 LCD의 기술력이 날로 발전하고 있다. 이번 SID 2015에서 BOE는 world largest 110inch 8K와 world first 82inch 10K 해상도의 LCD panel을 전시하였으며, CSOT는 world largest 110inch UHD curved LCD TV를 메인에 전시하여 관람객들의 큰 이목을 끌었다. 이는 한국과 일본 panel 업체들보다 한발 앞서 초고해상도와 대면적 LCD panel을 전시함으로써 더 이상 중국이 한국과 일본의 기술력을 충분히 따라잡았다는 것을 보여주기 충분했다.

또한 BOE는 색재현률 99%의 27inch QHD LCD panel을, CSOT는 118% 색재현률의 55inch UHD LCD panel을 전시하였으며 특히 CSOT는 4mm두께의 32inch FHD LCD TV와 5.5mm 두께의 4K curved LCD panel을 전시하여 OLED의 장점인 색재현율과 얇은 두께까지 LCD로서 따라잡을 수 있다는 것을 보여주었다. 이와 같이 LCD의 지속적인 신기술 개발과 가격경쟁력을 바탕으로 차세대 디스플레이를 놓고 OLED와의 주도권 싸움이 다시 한번 치열해 질 것으로 예상된다.

현재 대면적 TV 시장은 LCD가 주도하고 있으며 OLED가 서서히 프리미엄 TV 시장부터 시장을 확대해 나가고 있다. 프리미엄 시장에서도 LCD가 가격경쟁력을 바탕으로 QD film을 적용한 LCD TV로서 한발 앞서나가고 있는 상황이다. 따라서 이러한 LCD의 OLED의 장점을 따라잡는 개발이 앞으로의 OLED의 시장 개화에 걸림돌이 될 수 있을 것으로 예상된다.

LCD는 색재현율과 두께, 명암비, 응답속도 등이 지속적으로 개선되고 OLED와 근접한 수준까지 개발될 수는 있지만 모든 면에서 OLED와 같을 수는 없다. 예를 들어 두께를 줄이게 되면 색재현율을 높이기 위해 QD film을 적용하기가 어렵다. 여러 장점이 동시에 개선된 panel이 개발된다 하더라고 많은 시간이 소요될 것으로 예상되며, 그 전에 먼저 OLED의 가격이 LCD 수준으로 낮아질 것으로 전망된다. 따라서 OLED의 적극적인 투자와 수율 확보로 panel 가격을 낮추는 것이 차세대 디스플레이시장을 주도하기 위한 필수 조건으로 판단된다.