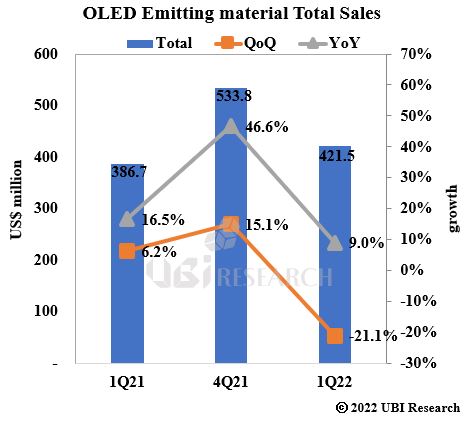

1Q of 2022 OLED Emitting Material Market $420 million, up 9% Compared to the Same Quarter of the Previous Year

According to “2Q22 OLED Emitting Material Market Track”, a quarterly report published by UBI Research, the sales of emitting materials in the first quarter were $421 million, down 21.1% (QoQ) from $533 million in the previous quarter but was an increase by 9% (YoY)when compared to $386 million in the first quarter of 2021.

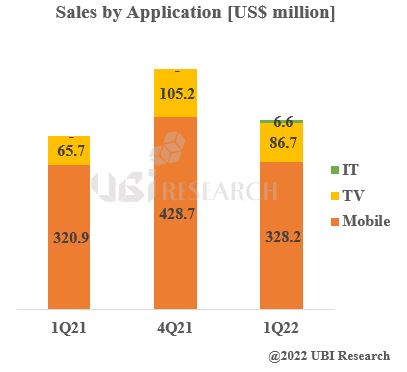

Although sales of emitting materials for TV and mobile devices decreased compared to the previous quarter, IT sales recorded a meaningful figure of $6.6 million. Although sales fluctuate depending on seasonal demand for applied products, if the sales of emitting materials are analyzed by application product, TV use is gradually increasing.

The top 3 companies in 1Q sales were UDC($86.6 million), DuPont($41.3 million), and Duksan($37.5 million). Duksan became the number one company in sales as a Korean company. The overall sales of luminescent materials in the first quarter decreased compared to the previous quarter but only UDC’s sales increased. Sales decreased to $421.5 million in 1Q22 from $533.8 million in 4Q21. However, UDC’s 1Q22 sales increased to $86.6 million from 4Q21’s sales of $85.5 million. It is estimated that this is due to the rise in the price of rare earth metals, a key material for manufacturing dopant.

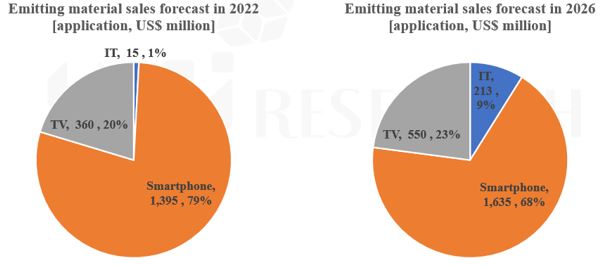

Estimated sales of emitting materials in 2022 are $1.77 billion and are expected to grow to $2.4 billion in 2026.

By application product, the projected sales of emitting materials for smartphones this year are $1.4 billion, accounting for 79% of the total.

Of the projected sales in 2026, emitting materials for TV are expected to reach $550 million, which is expected to increase by 23%. In addition, emitting materials for IT are expected to account for 9% of $210 million.

“OLED Emitting Material Market Track” surveys and analyzes the market for quarterly OLED emitting materials. The total market of light emitting materials was identified by examining sales by light emitting layer and common layer. Performance analysis was categorized by country, panel maker, application product, layer, and OLED method (RGB, WRGB, QD-OLED). In addition, OLED market information for the next five years (up to 2026) was forecasted by predicting the amount of emitting material usage and sales by company. The quarterly market track provides necessary information to industry professionals who lead the OLED industry.