Approval of LG Display Plant in China, cementing the global No.1position in large OLED market

LG Display has earned approval to invest in Gen 8.5 OLED panel plant in Guangzhou, China. As the government, who has delayed the approval due to the possible technology leakage, finally gives ‘a conditional approval’ for the plan, the construction of large size OLED panel factory will embark on.

The Ministry of Trade, Industry, and Energy (MOTIE) hosted ‘the 17th Industrial Technology protection Committee’ on June 26th, in which government officials and 20 civilian members participated to approve LG Display’s overseas expansion of OLED panel manufacturing technology on the condition of maintaining the localization ratio of equipment and materials to a certain level, preparing local security measures, and investing in next-generation technologies in Korea.

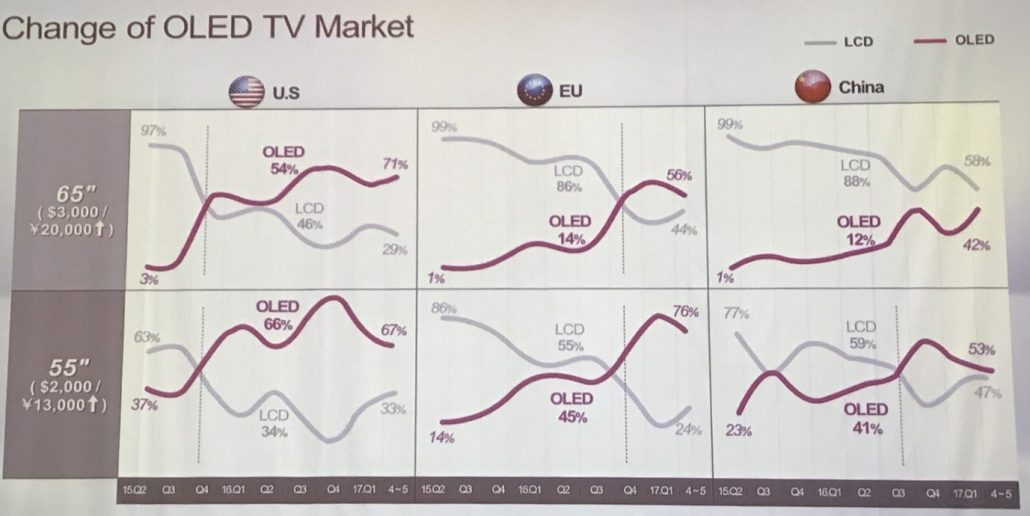

This approval would be a chance for LG Display to further increase the productivity of large size OLED panels and strengthen its market competitiveness. In addition, they can expect sales growth and tariff reduction in Chinese TV market. At the IMID 2018 held in BEXCO in Busan last August, LG Display CTO In-Byeong Kang said, “ Recently OLED TV has overtaken LCD TV market share in North and Central Americas and Europe, but not yet in China. We will increase our market share of OLED TV in China, which is recently being raised as a largest TV market in the world.”

<Market share of global OLED TV market: LG Display>

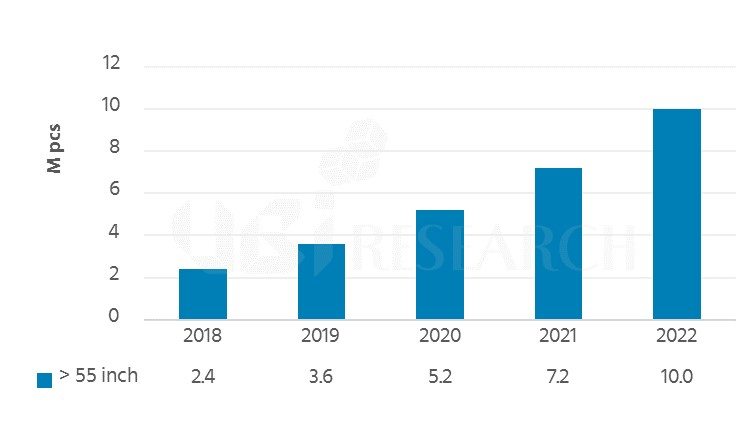

LG Display plans to strengthen its presence in larger OLEDs by completing both the newly approved Guangzhou Gen OLED line and Paju Gen 10.5 line. According to UBI Research, LG Display’s 55-inch and larger OLED panel shipments are projected to increase from 2.4 million units in 2018 to 10 million units in 2022.

<Expectation of 55-inch and larger OLED panel shipments 55 inch >