What is the investment cost for large-area OLED that will lead the premium TV market?

■ Investment cost comparison and analysis for WRGB OLED, solution processed OLED and QD-OLED

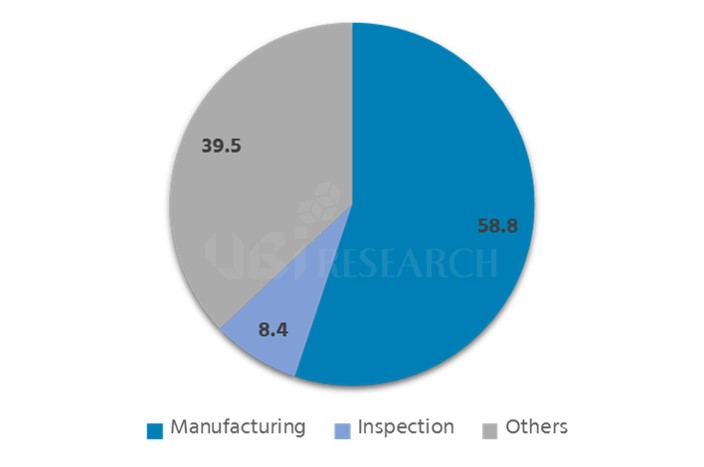

■ Total OLED process equipment is expected to form a market of US$ 58.8 billion from 2018 to 2022, and inspection equipment market is estimated as US$ 8.4 billion

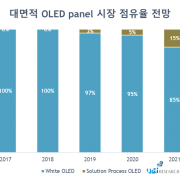

In the premium TV market, the market share of OLED TVs is steadily rising, and the number of OLED TV camps is gradually increasing. OLED TV adopts color filter to WRGB OLED, and currently LG Display only mass produces the OLED panels.

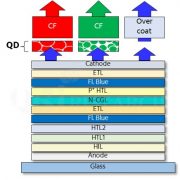

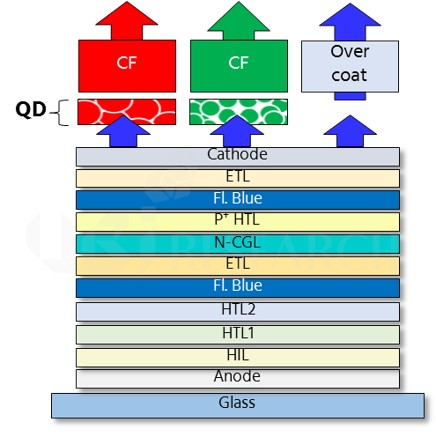

On the other hand, Samsung Display is developing QD-OLED (blue OLED + quantum dot color filter) to compete with WRGB OLED in the premium TV market. Blue OLED is a technology in which the blue light emitted from OLED passes through a quantum dot layer and a color filter to represent red and green colors.

<Expected structure of QD-OLED>

UBI Research analyzed the structure and investment amount of WRGB OLED and QD-OLED, which are the latest issues, in the‘AMOLED Manufacturing and Inspection Equipment Industry Report’ published on June 6. In addition, the investment amount of the solution process OLED, which has got the industry attention due to its possible implementation of real RGB in large-area OLED, is also analyzed and compared.

As a result of analyzing the equipment investment cost based on the 8th generation 26K, the QD-OLED investment cost is 3% higher than WRGB OLED and the investment cost of solution process OLED is 19% less than that of WRGB OLED.

In the QD-OLED investment cost, it is reflected that QD color filter is separately formed and its laminating process is added. For the analysis of solution processed OLED investment cost, color filter is excluded and ink-jet printer is applied instead of deposition equipment.

In addition, the report forecasts the overall OLED equipment market from 2018 to 2022. The total OLED overall equipment market is expected to reach US$ 106.7 billion from 2018 to 2022. The market for process equipment is projected as US$ 58.8 billion and inspection equipment market is to be US$ 8.4 billion.