OLED material makers, why are they going to China?

Recently, OLED material makers are seeking to establish their R & D centers in China.

According to the industry sources, LG Chemical is considering to establish OLED material technology center in Chengdu, China. Merck also announced on June 20 that it will establish its OLED Technology Center in Shanghai, China.

An official from Merck said, “By establishing OLED Technology Center in China, we expect to shorten the product launch period since close cooperation with Chinese companies is possible.In addition, the center will be used as a joint workplace for creating ideal solutions with Chinese companies since it is located in Shanghai.”

This trend of OLED material makers is interpreted as aiming at the growing Chinese market.

If they build their base in China, it will be easy to use the localization strategy specialized in the Chinese market and to secure their suppliers.

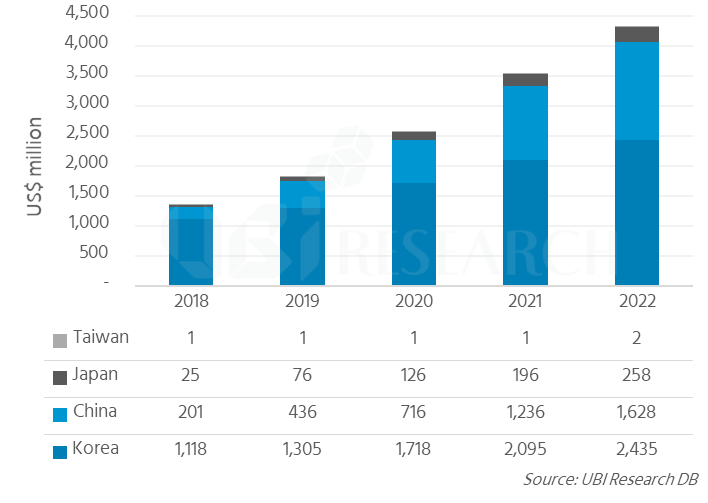

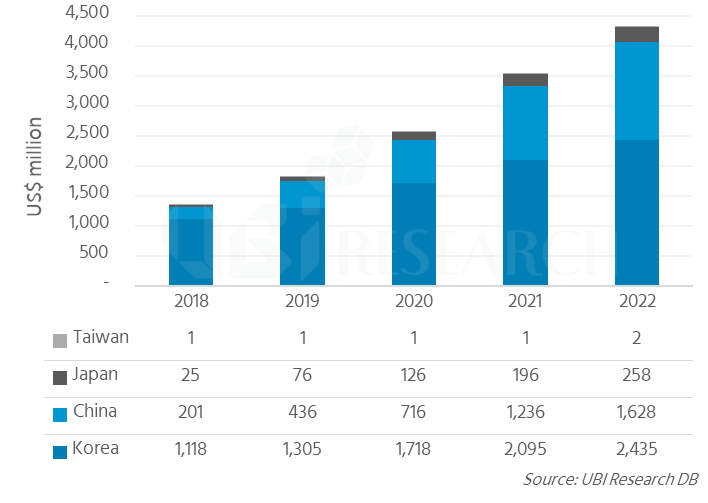

According to UBI research, the OLED market in China will grow at a CAGR of 75%, four times faster than Korea, which is currently the largest market.

In the ‘2018 OLED Emitting Material Industry Report’ issued in June, UBI predicts “ While Korean OLED emitting material market will grow at a CAGR of 21%, China’s OLED material market is expected to grow at a CAGR of 69%, to about US$ 1.16 billion in 2022. This will account for about 38% of the total OLED material market.”

<Emitting material market forecast by country, source: UBI Research>