Growing into the mainstream of OLED growth by expanding large OLED, differentiated products and supply

■ Small and Medium-sized POLED, strengthening fundamental business capacity and preparing future products such as Foldable

■ Develop commercial and automotive products, new technologies / new markets and develop into first-class business

LG Display is one of the world’s largest electronics exhibitors, and will hold a press conference at the Las Vegas Convention Center (LVCC) in Las Vegas on June 7, the day before the opening of the Consumer Electronics Show (CES) with Han vice chairman, executive vice president Kang In-Byoung, Strategy and Marketing Group Director Song Young-kwon, and other executives.

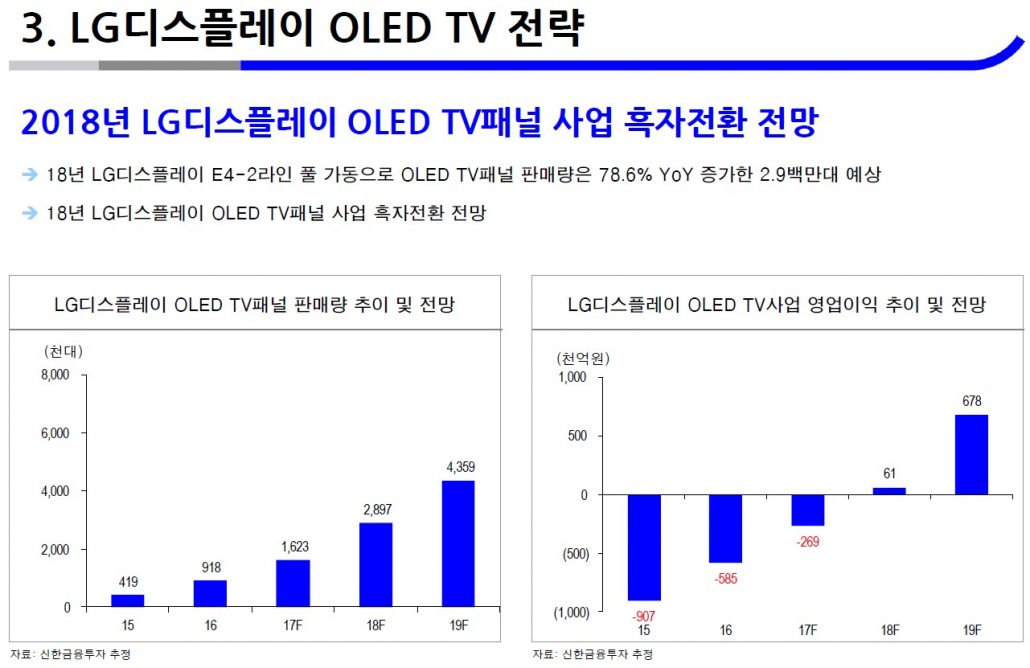

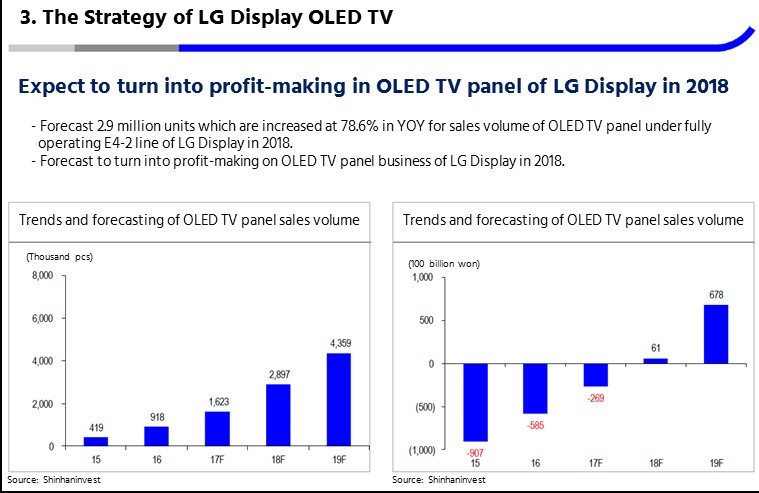

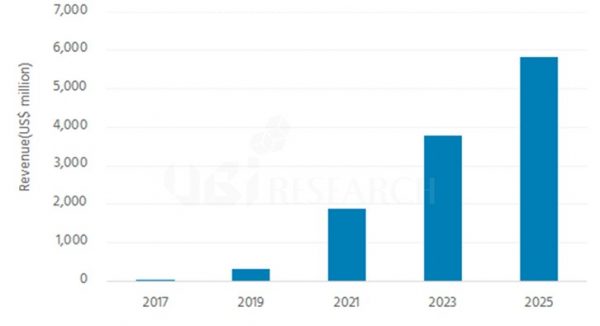

At the meeting, Han Sang-bum said, “Although there were many difficulties due to excessive supply and enormous investment due to intensified global competition last year, large-sized OLED business turned to surplus and stable profit was generated mainly in high value-added products. “This year, LG Display will focus on OLED investments, accelerating OLED growth, and focus on commercial and automotive businesses. By 2020, LGD will account for more than 50% of total OLED and growth businesses. “He said.

To this end, LG Display plans to expand its large-size OLED market, strengthen its fundamental business capabilities in small- and mid-sized P-OLED (plastic OLED) businesses, and develop new markets with differentiated commercial and automotive products.

■ Large OLED, differentiated products and supply expansion

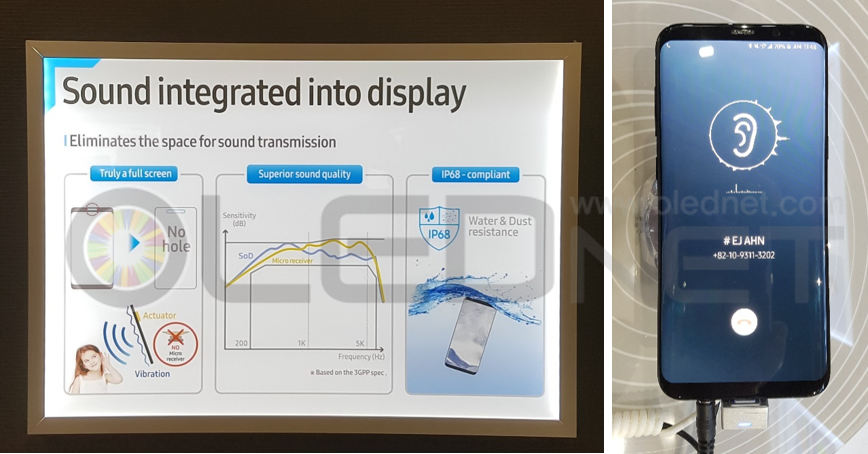

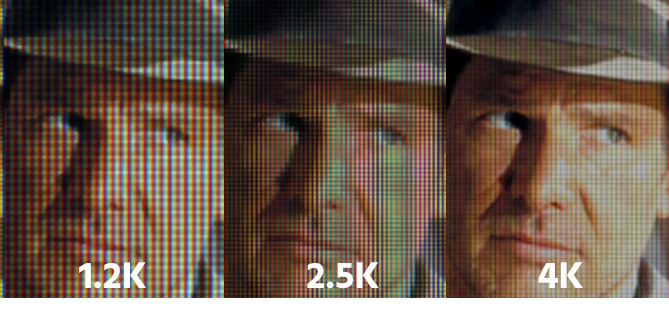

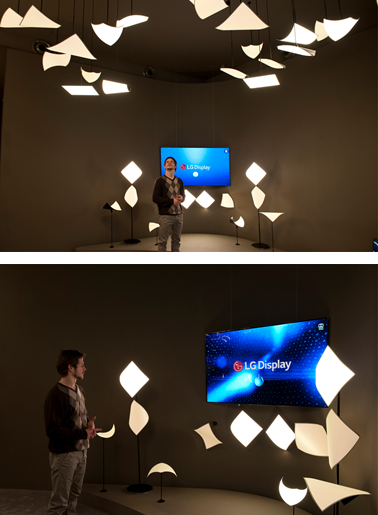

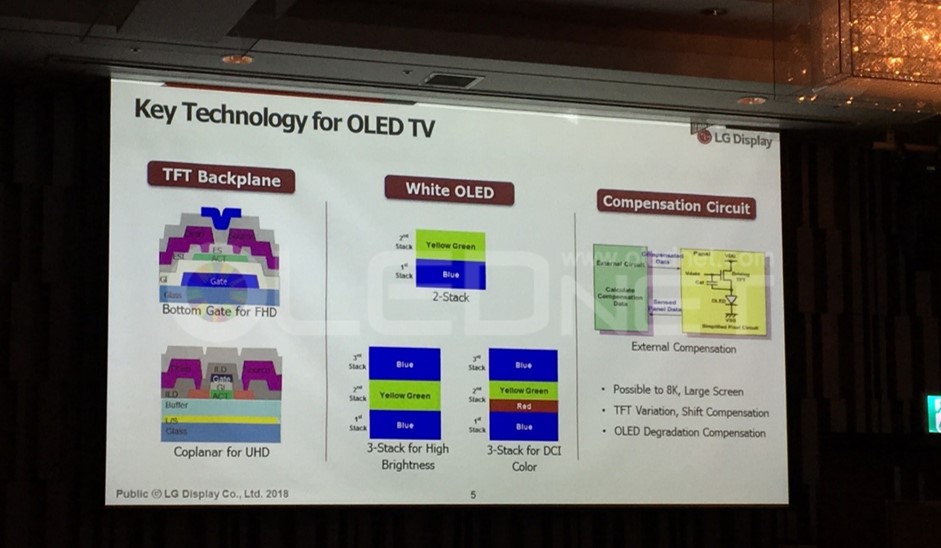

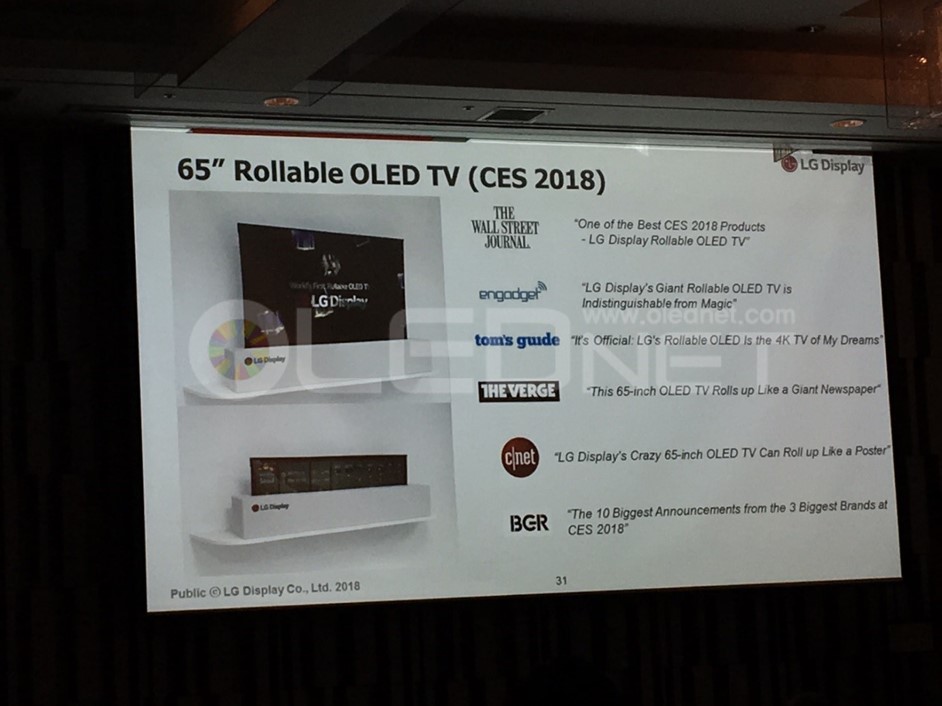

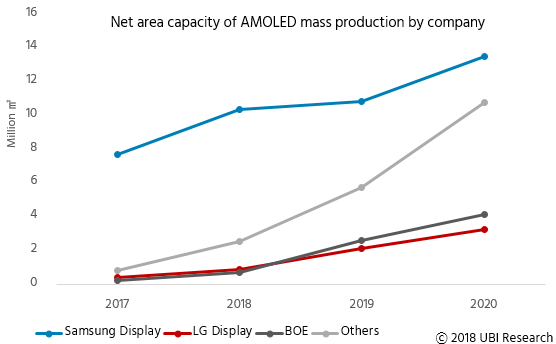

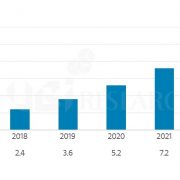

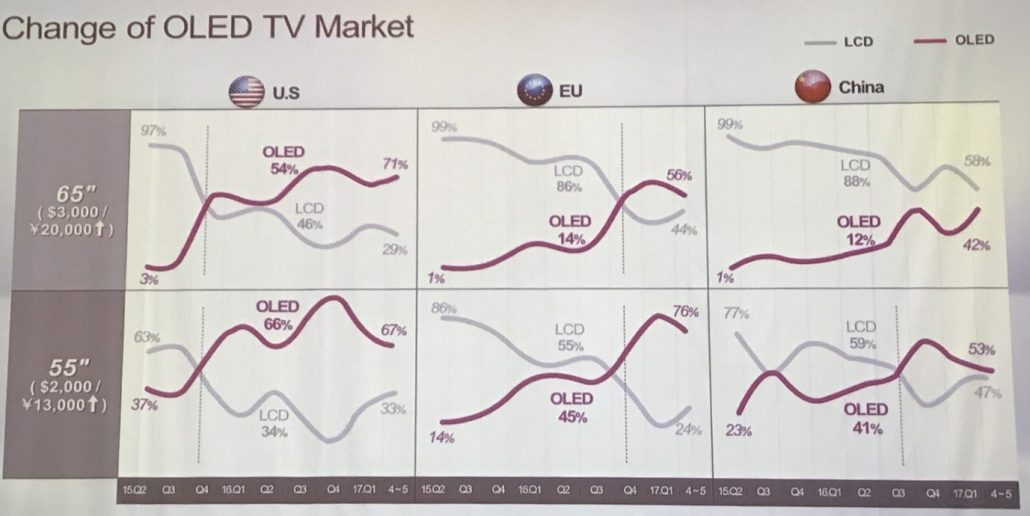

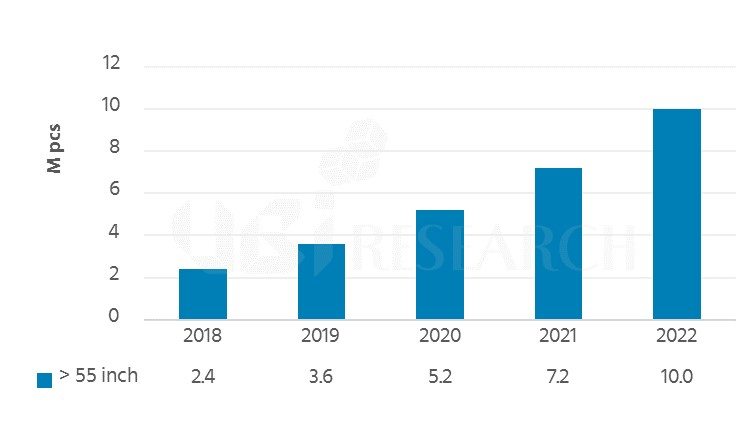

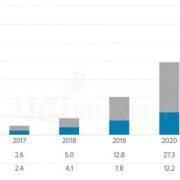

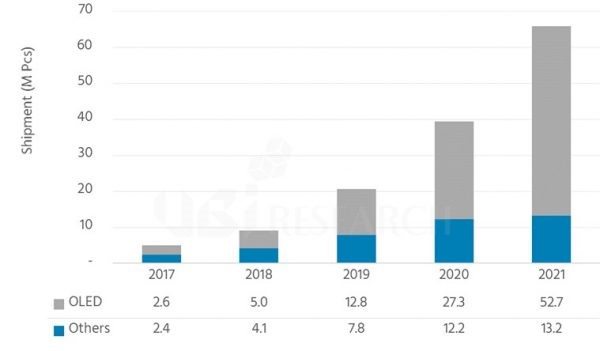

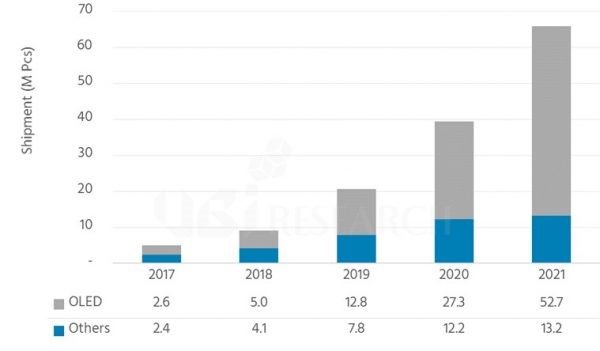

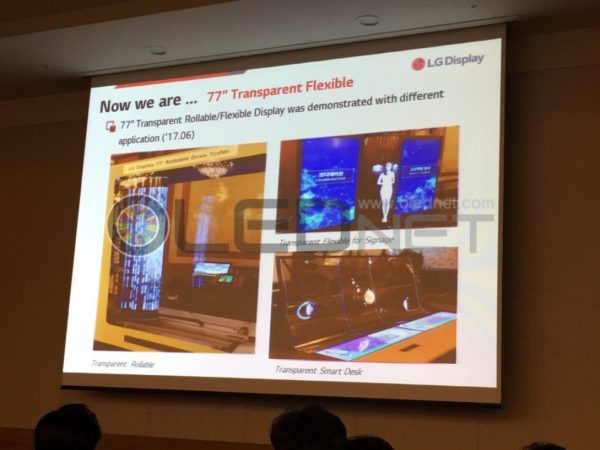

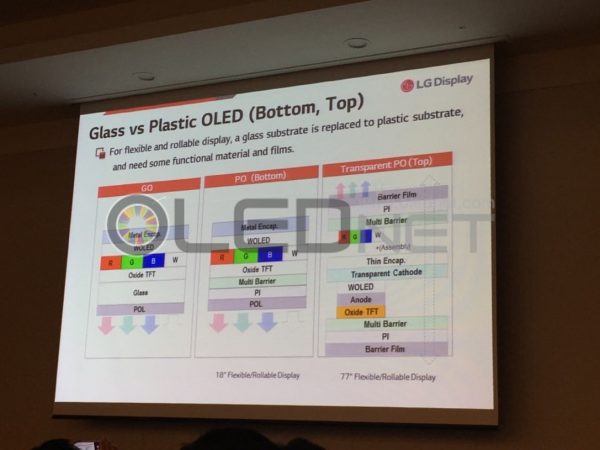

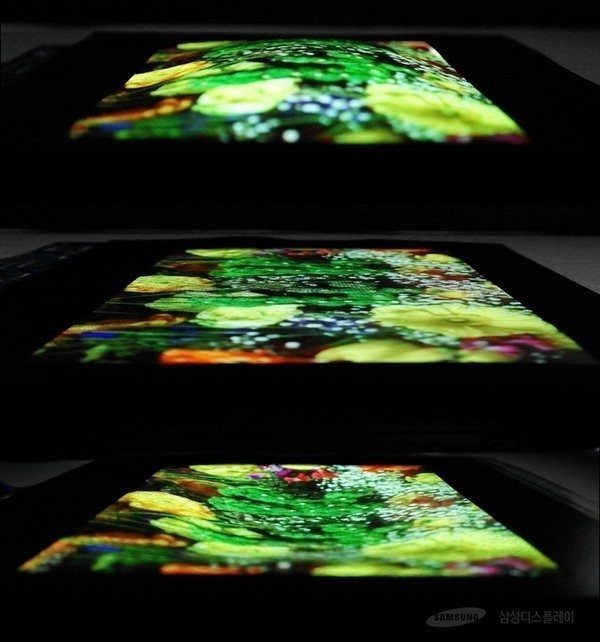

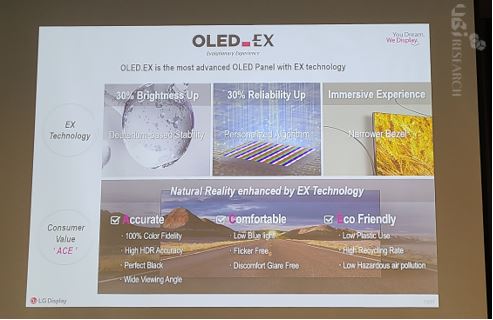

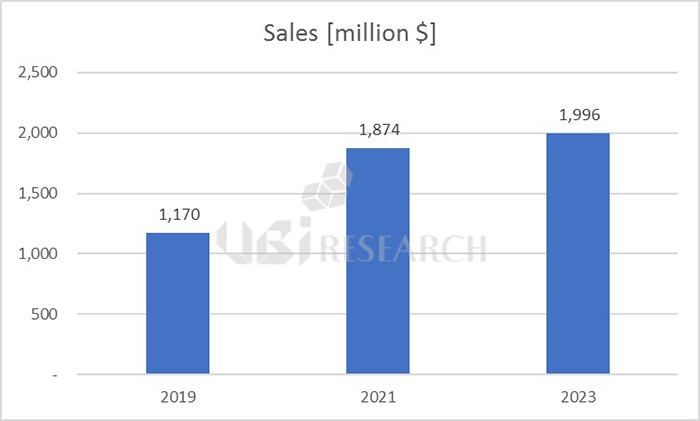

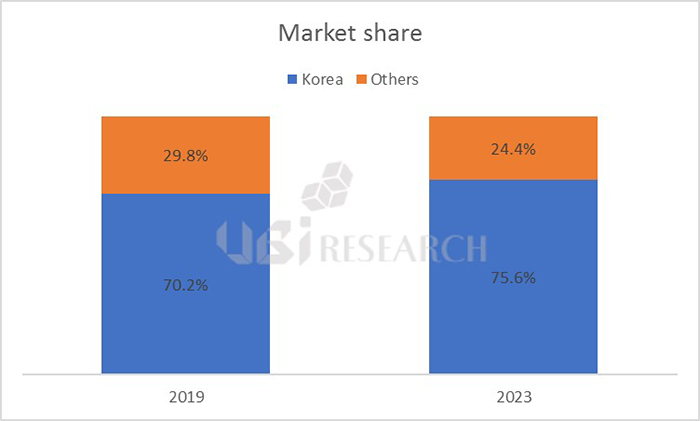

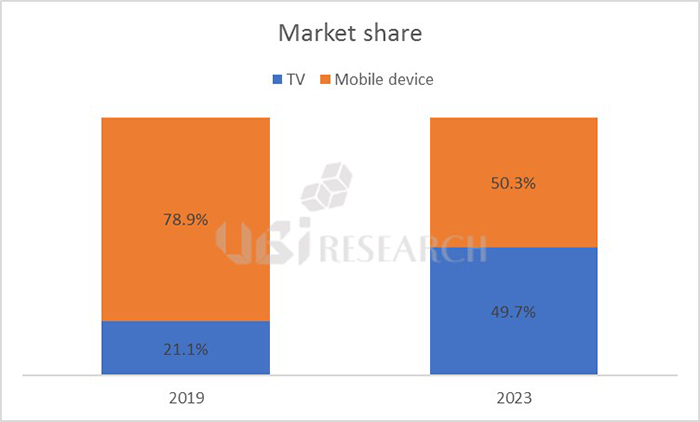

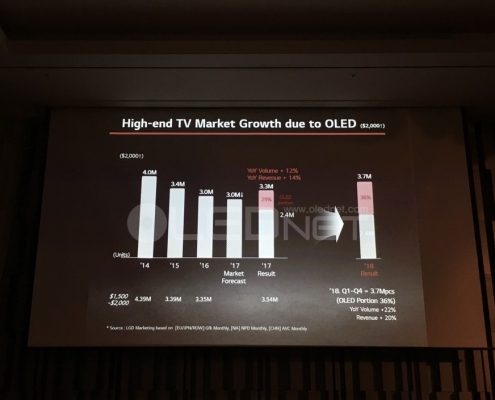

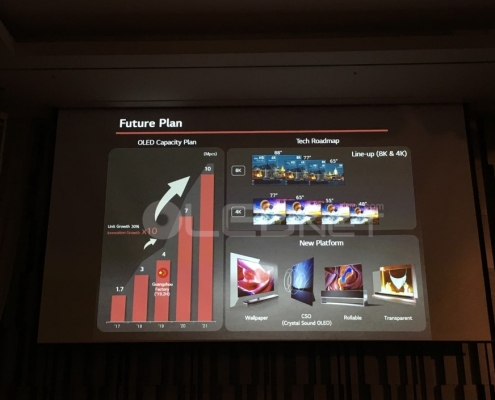

Since LG Display first supplied OLED TV panels in 2013, LG Display has continued to develop its technology. And last year, it sold nearly 3 million units and developed into a strong player in the premium TV market. This year, the company plans to expand its TV product lineup from the existing 4K resolution to 8K, and to further enhance its competitiveness by further enhancing performance such as luminance and response time. In addition, the company will expand its market by expanding differentiated products such as wall paper, CSO (Crystal Sound OLED), rollable and transparent display. LG Display will complete the G8.5 OLED panel factory in Guangzhou, China in the first half of this year, and mass-produce OLED from the third quarter. Through this, the company plans to expand its sales volume from 2.9 million units in 2018 to 4 million units this year, and to achieve more than 10 million units in 2021.

In addition, LGD will expand sales areas for existing customers, strengthen collaboration with strategic customers, and increase sales of premium products such as ultra-large size panel.

■ Small and mid-sized P-OLED, strengthening fundamental business capacity and preparing future products.

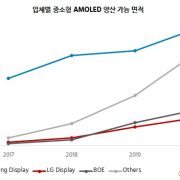

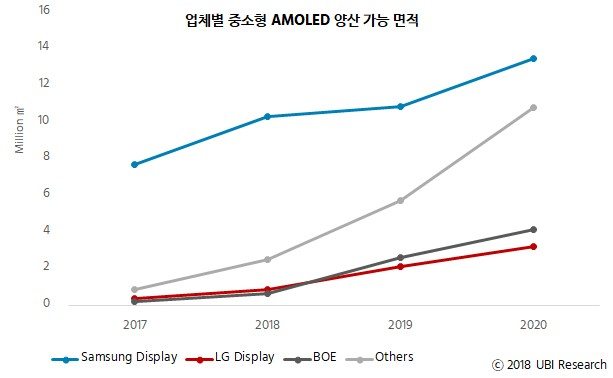

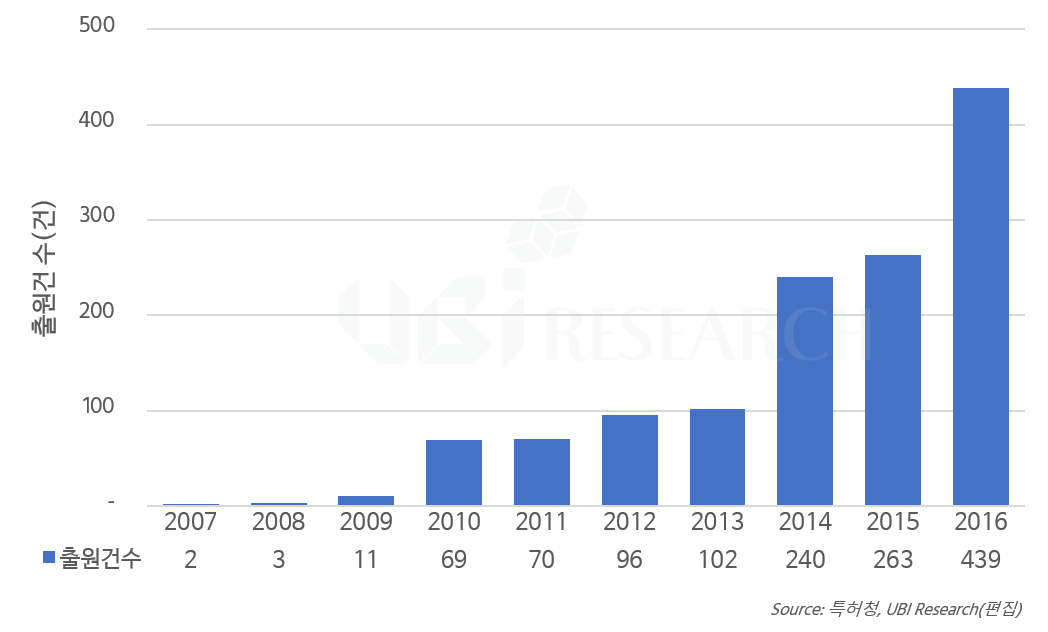

LG Display is targeting the small- and mid-sized OLED market through P-OLED.

This year, it is a great challenge to develop core technologies and products for strategic customers in a timely to raise market share of small- and medium-sized panel.

In addition, LGD plans to increase the production capacity of the Gen 6 Gumi factory, which has a capacity of 15,000 sheets per month, and to expand the P-OLED production capacity by early stabilizing the Gen 6 factory in Paju.

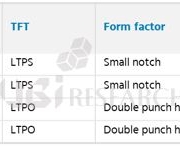

In addition, LGD plans to steadily prepare related technologies and infrastructure so that future products such as Foldable can be released on time.

■ Commercial and automotive displays, Fostering first-class business

LG Display nurtures the rapidly growing commercial and automotive businesses to first-class business.

In the commercial market, LGD plans to pursue differentiated products such as 98 and 86 inches, ultra-slim products such as in-touch, bezel of 0.44 mm, transparent and gaming.

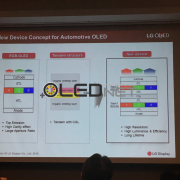

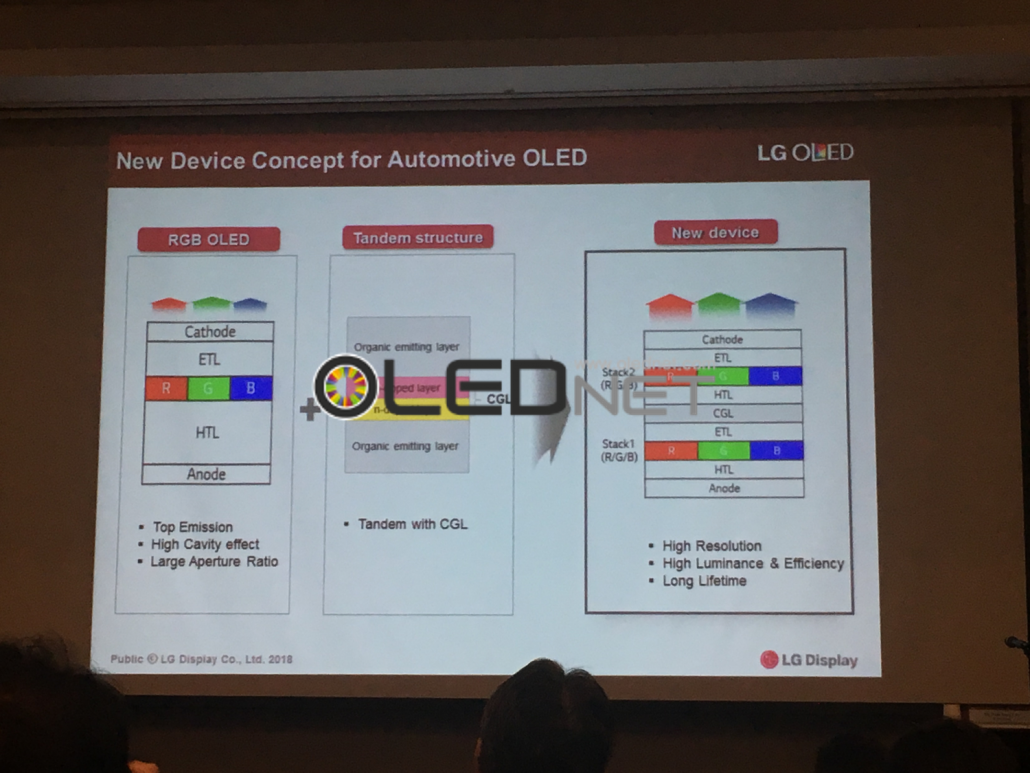

For automobiles, LTPS-based high-resolution LCDs and P-OLEDs are expected to focus on 8-inch and larger screens and high-resolution products. In addition, LGD will prepare its production infrastructure to expand its business in a timely manner and further strengthen its cost competitiveness, thereby achieving the first place in the fast growing auto market.

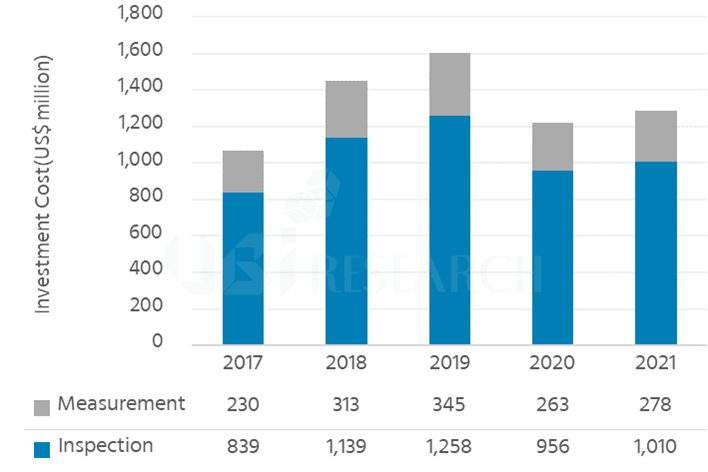

This year LGD plans to complete investment in preparation for the future, which began in 2017. LGD Han Sang-Bum, vice chairman of LG Display, said, “LG Display will be able to lead the global display market once again with OLED.

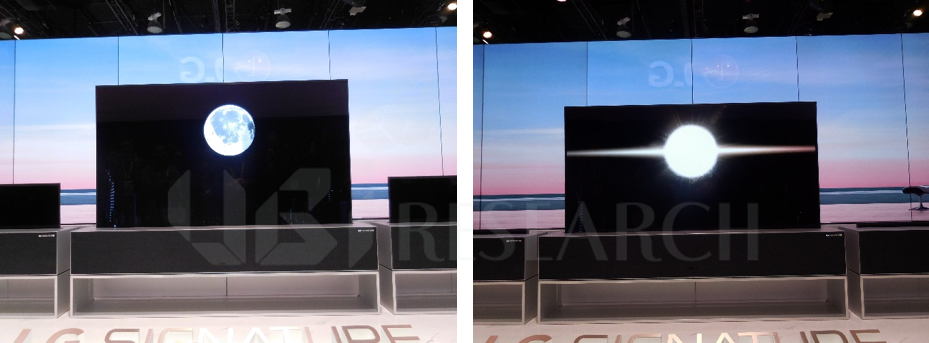

<LG Electronics, OLED TV R>

<LG Electronics, OLED TV R>